With the globalization of financial markets and the rise of online trading, more platforms are emerging to attract individual investors to trade assets such as forex, futures, and stocks. Apex Trader Funding is one such platform, offering a wide range of trading tools since its inception in 2021. Despite its many features, the company’s lack of transparent registration information and regulatory oversight raises concerns about its safety and legitimacy.

This article analyzes the risks associated with unregulated platforms and highlights several real-life cases of traders facing potential dangers on such platforms, helping investors better understand the characteristics and risks of using Apex Trader Funding.

Background of Apex Trader Funding

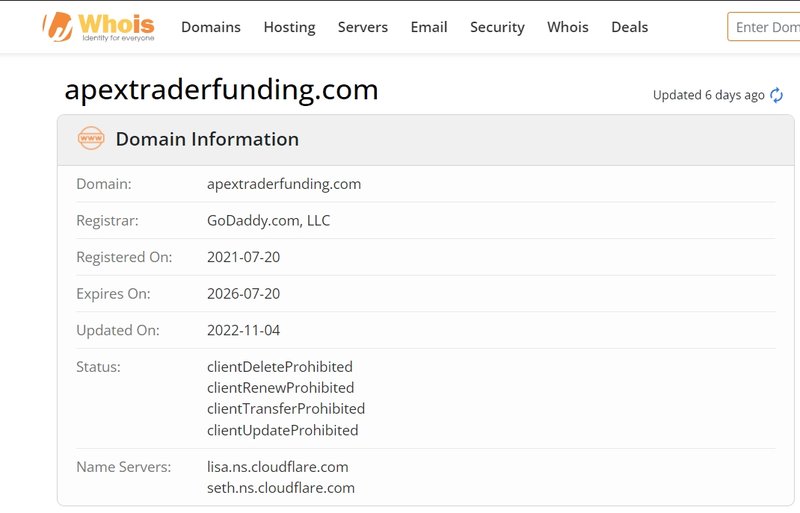

Apex Trader Funding Inc. began operations in July 2021, offering online trading in forex, futures, and stocks. The platform provides a wide range of tools and services. However, its transparency is questionable. The company’s registration details are not fully available to the public. Apex Trader Funding lacks regulation from any international or domestic financial authorities. This raises concerns about its compliance and the safety of users’ funds.

Risks of Unregulated Platforms: Real-Life Case Studies

In financial markets, regulatory authorities play a crucial role in ensuring that trading platforms are legitimate and that investor funds are safe. However, platforms like Apex Trader Funding, which are not regulated, may pose risks in terms of trading execution, fund handling, and customer protection. The following real-life cases highlight the dangers that traders may face on such platforms.

Case 1: FXCM’s Regulatory Issues

FXCM was once a major player in global forex trading. FXCM operated under regulation in several countries but faced a U.S. ban in 2017. The Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) penalized the company for manipulating market prices, leading to its removal from the U.S. market. The investigation revealed that FXCM had manipulated quotes in multiple trades, leading to substantial customer losses. While FXCM continues to operate in other regions, this case demonstrates that even regulated platforms can pose risks to investors.

This case serves as a reminder that operational transparency and regulatory compliance are crucial. Since Apex Trader Funding is unregulated, users may face similar risks, especially in cases of market manipulation or unfair trading practices.

Case 2: LCG’s Liquidity Problems

London Capital Group (LCG) was a well-known platform for forex and CFD trading, but in 2019, the company faced financial difficulties and abruptly halted withdrawals for some clients. Many investors were unable to access their funds in time, resulting in significant losses. Although LCG was regulated by the UK’s Financial Conduct Authority (FCA), liquidity issues and financial instability still affected the platform’s operations, leading to frozen assets.

Investors using Apex Trader Funding could face similar liquidity risks, especially since the platform is unregulated. If the platform faces financial crises or liquidity problems, users may encounter delays or difficulties in withdrawing their funds, with little legal recourse available.

Case 3: OptionRally’s Illegal Operations

OptionRally, an online platform offering binary options trading, attracted a large number of investors before it was forced to shut down in 2017. Multiple financial regulators accused the platform of operating illegally, as it was not licensed in many countries. The platform lured investors with promises of high returns, but many users eventually found themselves unable to withdraw their funds, and the company failed to offer any customer protection.

This case highlights the legal risks associated with unregulated platforms. While Apex Trader Funding has not faced similar accusations, the lack of regulatory oversight raises concerns about the platform’s ability to protect users from legal or financial issues.

Case 4: Banc De Binary’s Fraudulent Activities

Banc De Binary was a well-known binary options trading platform that attracted thousands of investors worldwide. The company promised high returns and ran large advertising campaigns. However, in 2016, Banc De Binary was fined and shut down by the U.S. Securities and Exchange Commission (SEC) and the UK’s FCA for fraud and illegal operations. Many investors lost their entire investments, and funds were difficult to recover.

This case shows how platforms, when operating without strong regulatory oversight, can engage in fraudulent activities. Although Apex Trader Funding has no such history, the lack of regulatory supervision means that investors should remain vigilant to avoid potential issues.

Importance of Transparency and Fund Security

For any investor, one of the most critical factors when choosing a trading platform is transparency and fund security. Regulatory oversight and operational transparency not only provide legitimacy to a platform but also offer financial protection for users.

Some major regulated platforms, such as eToro and IG Group, operate with full transparency and are overseen by financial regulatory bodies, such as the FCA or the Australian Securities and Investments Commission (ASIC). These platforms ensure that client funds are segregated from company operating funds, meaning that in the event of financial trouble, client assets are protected. In contrast, with Apex Trader Funding being unregulated, it remains uncertain whether user funds are adequately safeguarded.

Case Study: Fund Security on Regulated Platforms

For example, on the regulated platform IG Group, client funds are segregated from the company’s operational funds, as required by the FCA. When one investor faced a temporary technical issue that impacted their trading account, IG Group’s customer support quickly resolved the issue, ensuring that the investor’s funds were secure. Additionally, the platform offers a compensation scheme to protect user funds in the event of financial trouble.

On the other hand, Apex Trader Funding’s lack of transparency and regulatory oversight leaves users’ funds vulnerable, as it is unclear whether similar protective measures are in place.

Risks of High Leverage

Apex Trader Funding offers high leverage to its users. While leverage can amplify potential profits, it also increases the risk of significant losses, especially during periods of market volatility. Trading on unregulated platforms, particularly those offering high leverage, can expose traders to even greater risks, as there may be limited mechanisms in place to manage or control losses.

Case Study: The Dangers of High Leverage

In 2015, the Swiss National Bank removed the Swiss franc’s peg to the euro, leading to a major financial shock in the markets. Many traders using high leverage suffered significant losses, and several forex brokers were forced to shut down due to the massive capital losses. This event demonstrated how quickly high leverage can wipe out investments during extreme market events.

For investors using Apex Trader Funding, which is unregulated, the risks of trading with high leverage can be even greater. It is essential for traders to fully understand the dangers and implement proper risk management strategies.

How to Reduce Risks When Using Apex Trader Funding

While Apex Trader Funding provides various tools and market options for traders, investors should take the following measures to reduce risks when using the platform:

- Start with Small Amounts: It is advisable for investors to begin with small amounts of capital to assess the platform’s liquidity and operational stability.

- Risk Management: Implement strict stop-loss strategies and manage leverage ratios to avoid significant losses during volatile markets.

- Withdraw Regularly: Make regular withdrawals from the platform to ensure that funds can be transferred smoothly and without delays.

- Monitor User Feedback: Keep track of other users’ experiences and reviews to stay informed about any issues related to withdrawals or platform operations.

Frequently Asked Questions (FAQs)

1. Is Apex Trader Funding regulated?

No, Apex Trader Funding is currently not regulated by any international or domestic financial authorities.

2. What are the main risks of using Apex Trader Funding?

The primary risks include lack of fund security, withdrawal delays, and operational transparency, as the platform is unregulated.

3. How can I ensure my funds are safe on Apex Trader Funding?

Investors should start with small amounts, withdraw funds regularly, and implement strict risk management measures.

4. Does Apex Trader Funding offer high leverage trading?

Yes, Apex Trader Funding offers high leverage trading, which can amplify both profits and losses. Investors should be cautious when using leverage.

5. What issues can arise with unregulated platforms?

Unregulated platforms can experience withdrawal issues, fund insecurity, and unfair trading practices, with little protection for users.

6. How should I choose a safe trading platform?

Look for platforms regulated by reputable financial authorities such as the FCA or ASIC, which offer transparency, segregated accounts, and strong user protections.