OPEC+ Holds Output Steady as Oil Trades Near $63 a Barrel

OPEC+ is keeping its current output policy in place as Brent crude trades near $63, capping a soft year for oil prices. The group is prioritising price stability over fresh cuts while non-OPEC supply rises and demand growth slows, with major implications for global inflation, energy equities and key FX pairs tied to oil exporters and importers.

Bitcoin Loses $1 Trillion as Spot ETFs Suffer Record Outflows

The crypto market has wiped out around $1 trillion in value as Bitcoin tumbles sharply from recent all-time highs and U.S. spot Bitcoin ETFs post record monthly outflows. Institutional investors are aggressively de-risking, exposing structural fragilities in liquidity and leverage, and forcing a painful but classic post-euphoria reset in the crypto cycle.

ZYPROFX is suspected of being a scam!

ZYPROFX is a newly established online forex and CFD broker headquartered in Saint Lucia. Its domain zyprofx.com was registered in February 2025 and shows very low authority and traffic, indicating an early-stage, lightly visible operation. The company appears in Saint Lucia’s corporate registry but has no identifiable financial license from the FSRA or other major regulators. Although ZYPROFX claims to offer MT5 and multi-asset trading (forex, metals, energy, crypto, indices, CFDs), it does not provide clear access to the platform, detailed account conditions, or transparent funding policies, and relies mainly on VISA, Bitcoin, and UnionPay with limited support channels and no visible social media presence.

Gold Near Record Highs as $5,000 Forecasts Gain Traction

Gold is trading close to record highs as central banks ramp up buying and major banks publish aggressive price targets approaching $5,000 per ounce. Lower real yields, rate-cut expectations and persistent geopolitical risk are driving the move, making gold a core hedge asset for both institutional and retail investors.

Gold Slides Toward $2,280 as Yields Rise and Safe-Haven Demand Eases

Gold prices dropped toward $2,280 per ounce as US Treasury yields surged and geopolitical tensions eased. The stronger dollar and reduced central-bank buying weighed on bullion. Markets shifted away from safe-haven assets as investors reassessed inflation expectations and interest-rate outlooks.

FxCapLtd to Host Exclusive Online Market Seminar

FxCapLtd to Host Exclusive Online Market Seminar

FxCapLtd Gold Market Outlook 2025–2026 | Fed Cuts & Inflation

FxCapLtd Announces Upcoming Strategic Brand Refresh to Redefine Future Vision

Bitcoin Drops Below $95K as ETF Inflows Slow and Miner Selling Intensifies

Bitcoin fell under the $95,000 level as ETF inflows weakened and miners increased exchange sales. On-chain data shows rising miner outflows, while slowing institutional ETF demand added pressure to BTC markets. The retreat highlights growing sensitivity to US yields, liquidity conditions, and macro sentiment.

Dollar Surges to Three-Month High as Fed Signals Delayed Rate Cuts

The US dollar surged to a three-month high after the Federal Reserve signaled that rate cuts may be delayed. Hawkish comments from Chair Jerome Powell pushed Treasury yields higher and pressured major currency pairs including EUR/USD and GBP/USD. Markets rapidly repriced policy expectations, fueling a broad USD rally across global FX markets.

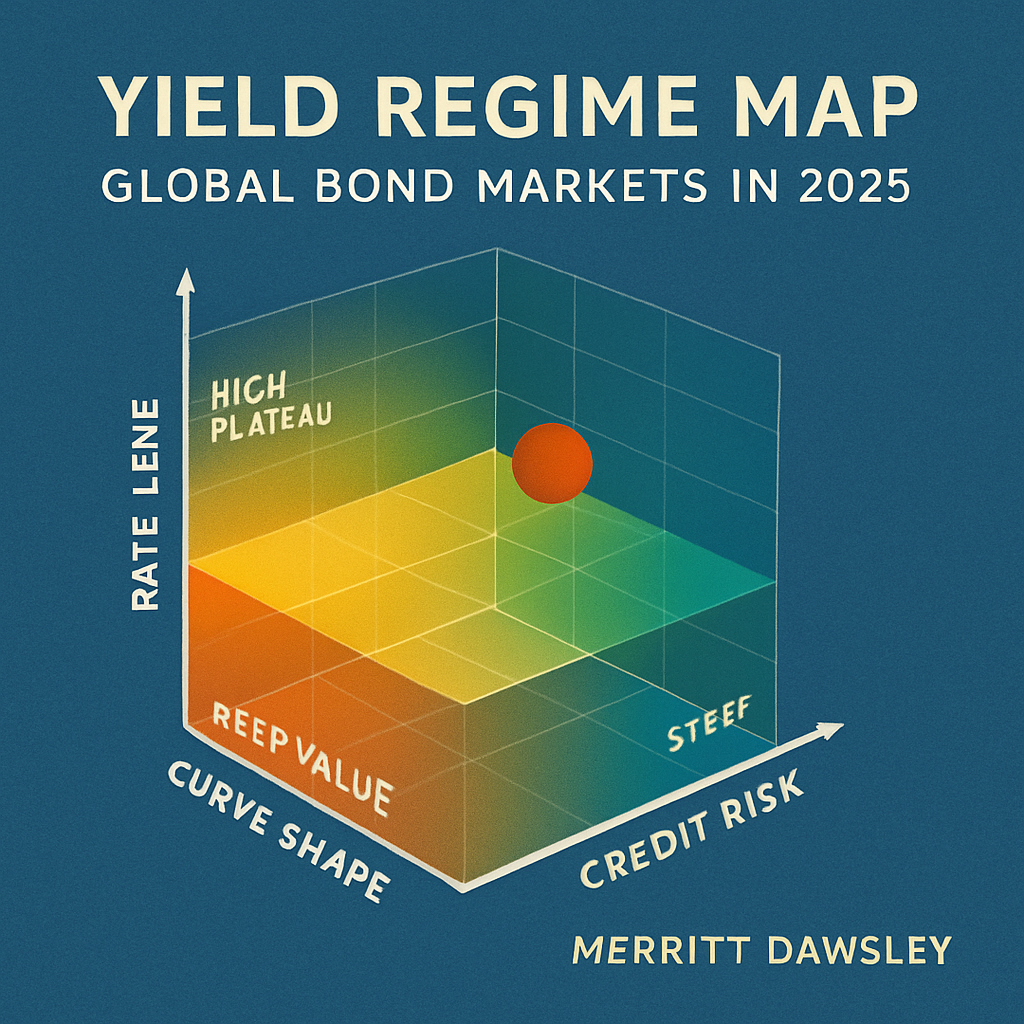

Merritt Dawsley’s Yield Regime Map: Global Bond Markets in 2025

Merritt Dawsley’s Yield Regime Map: Global Bond Markets in 2025