Oil Slides as Iran Tensions Ease and Supply Fears Cool

Crude prices fell as the market dialed back immediate escalation concerns involving Iran, unwinding the geopolitical risk premium that had supported oil earlier. With tensions appearing to cool, traders refocused on fundamentals such as inventory trends, supply expectations, and global demand signals. The move reinforces oil’s current regime: sharp headline-driven swings, but medium-term direction anchored by supply-demand balance.

Gold Sets Record High, Retreats on Profit-Taking

Gold surged to a fresh record high near $4,640/oz before easing as traders locked in gains and assessed shifting interest-rate expectations. The rally reflected strong safe-haven demand and ongoing sensitivity to the US dollar and real yields. With gold at historic levels, the market is now focused on whether price action transitions into healthy consolidation or deeper retracement as macro data reshapes rate-cut pricing.

Bitcoin Approaches $100K as Crypto Momentum Builds

Bitcoin rallied above the mid-$90,000 range, putting the market’s spotlight on the $100,000 psychological level. Traders attributed the move to improving risk sentiment, strong spot interest, and renewed momentum across major digital assets. The next key question is whether Bitcoin can break through $100K and hold it as a stable support zone, or if volatility and profit-taking will trigger a short-term pullback.

Crypto Stabilizes as US Signals Regulatory Clarity

Bitcoin and major cryptocurrencies steadied after US lawmakers indicated progress toward a clearer regulatory framework, reducing long-standing legal uncertainty for exchanges, tokens, and institutional investors.

Oil Prices Climb on OPEC Cuts and Middle East Risks

Crude oil prices moved higher as OPEC+ maintained supply discipline while geopolitical tensions in the Middle East raised concerns over shipping and production disruptions, tightening the global energy market.

Dollar Jumps After Strong US Jobs Data

The US dollar rose sharply after stronger-than-expected employment data reduced expectations for near-term Federal Reserve rate cuts. Higher Treasury yields attracted global capital flows into USD assets, pressuring major currencies such as the euro, pound, and yen.

Bitcoin Stabilizes as ETF Inflows Support Prices

Bitcoin stabilized following recent volatility as institutional ETF inflows helped offset cautious retail sentiment. The trend signals growing market maturity, with digital assets increasingly influenced by macro conditions and traditional investment flows.

Gold Holds Firm as Safe-Haven Demand Persists

Gold prices stayed near recent highs, supported by declining real yields, geopolitical uncertainty, and ongoing central bank demand. The metal’s resilience underscores its role as a defensive asset amid shifting monetary policy expectations and global risk concerns.

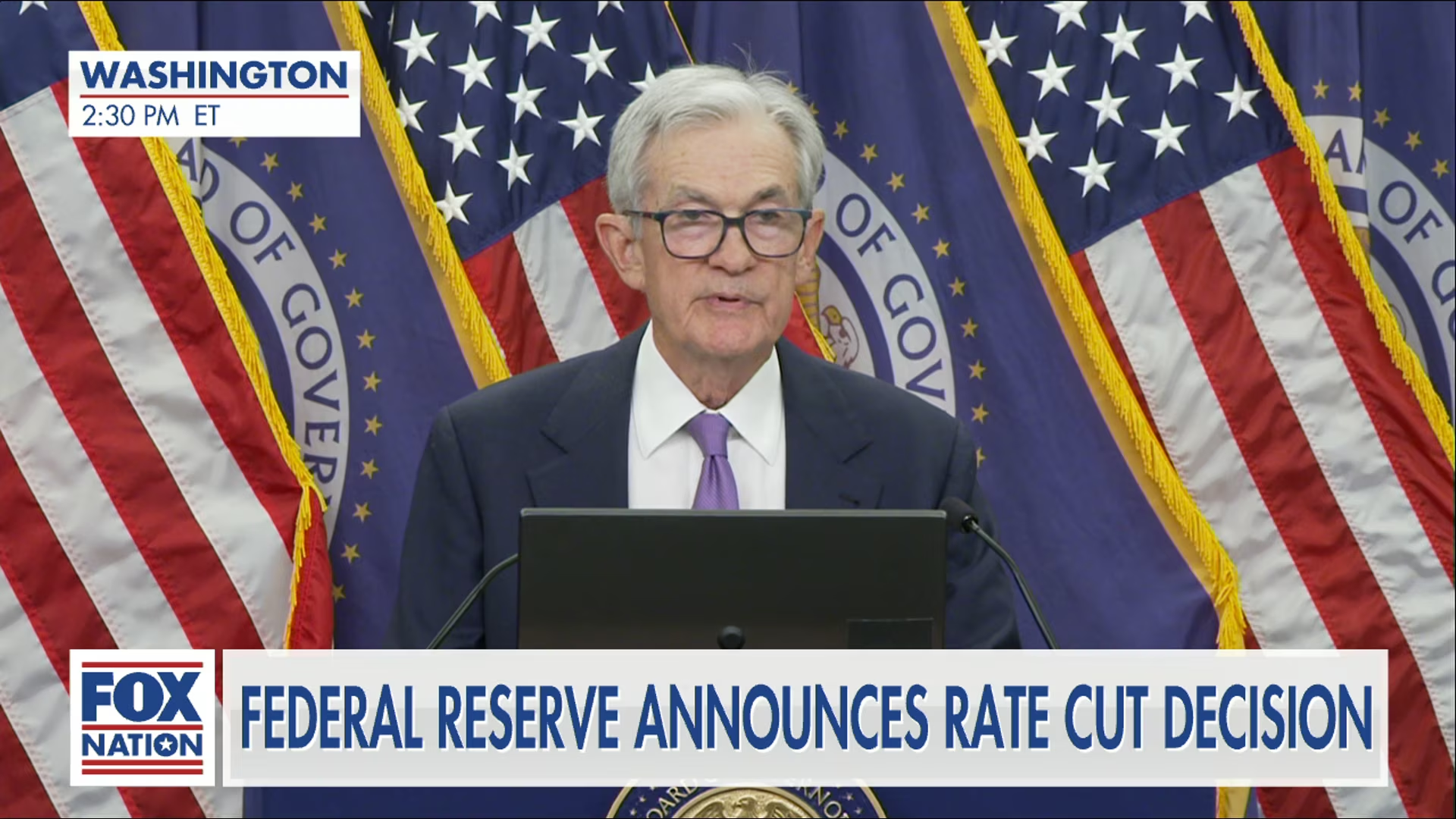

US Dollar Weakens as Rate-Cut Expectations Shift

The US dollar softened as markets reassessed the Federal Reserve’s interest rate outlook amid cooling inflation signals. Currency traders adjusted positions as expectations for future rate cuts gained traction, highlighting the dollar’s sensitivity to macroeconomic data and central bank communication.

Bitcoin Gains Support from Institutional ETF Flows

Bitcoin held firm as institutional inflows into spot Bitcoin ETFs continued to reshape market structure. Reduced selling pressure from long-term holders and improved regulatory access have strengthened Bitcoin’s position as a macro-sensitive alternative asset.