COF is positioned as a multi-asset online trading platform covering forex, commodities, indices, digital currencies, and futures. It promotes itself as a one-stop trading entry point built around multi-terminal access, flexible account options, and basic trading functionality. However, based on publicly verifiable signals, COF currently shows a short domain operating timeline, limited corporate disclosure, and regulatory claims that could not be confirmed through official channels during verification.

Platform Positioning and Service Model

A Unified Entry Point for Multiple Markets

COF frames its service as an integrated trading solution designed to combine several market categories inside one system. Instead of focusing on a single asset class, the platform highlights product diversity and attempts to meet different trading styles through one account environment.

Market Coverage in the Platform Description

From the information published on the COF website, the platform’s instrument offering follows a typical multi-asset CFD structure. It presents access to currency pairs, major commodities, indices, crypto-related products, and futures-style instruments, allowing users to switch between market sectors without changing platforms or accounts.

Domain and Launch Footprint Signals

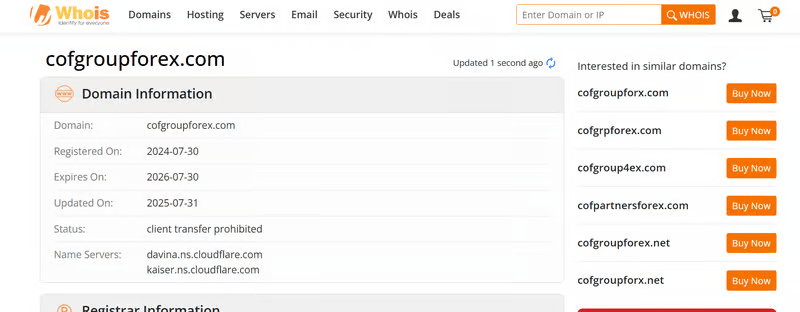

Domain Registration Timeline Suggests a Short Operating History

The domain cofgroupforex.com was registered on July 30, 2024, and updated on July 31, 2025, according to Whois search results. This timeline indicates the platform’s public-facing history is relatively short, and most of its visible activity falls within a limited period.

Why Domain History Matters for Credibility Assessment

A newer domain does not automatically indicate a platform is unsafe, but it reduces the amount of historical data that users can cross-check. When a platform has limited operational history, there is less evidence available to evaluate long-term service stability, public reputation, policy consistency, and how it responds to disputes or customer issues over time.

Trading Platform Experience and Terminal Support

ST5 as the Core Trading Platform

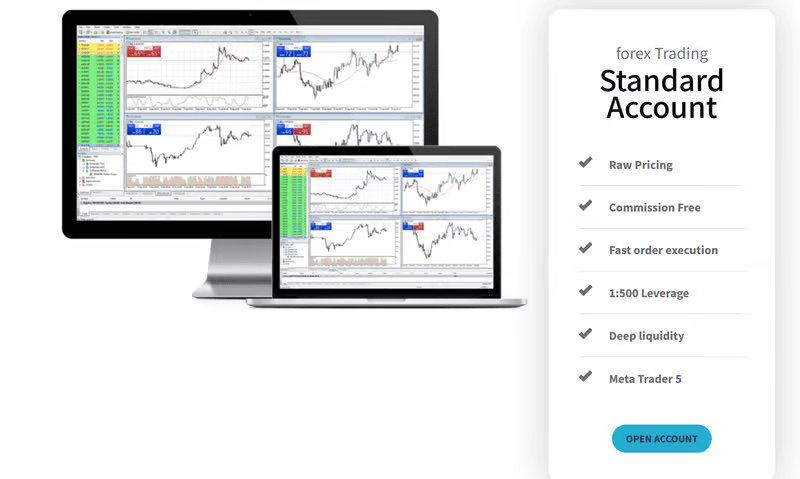

COF identifies ST5 as its main trading platform and highlights multi-device support across Windows, Mac, Android, and iOS. This structure suggests that the platform aims to provide a flexible trading experience, allowing users to manage positions and monitor the market from both desktop and mobile devices.

The Website’s MT5 Reference and What It Implies

COF also mentions MetaTrader 5 on its website. Based on the way the information is presented, this reference appears to be used to communicate that the platform’s trading features resemble those found in mainstream software. It does not necessarily confirm that COF provides direct access to the official MetaTrader 5 system itself. For many traders, the distinction matters because MT5 typically implies a specific ecosystem, established technical standards, and a recognizable execution and interface environment.

Account Types and Trading Conditions

Account Structure Designed Around Forex Trading

COF promotes a forex-focused account system that includes standard and low-spread variants, alongside a commission-free structure. This packaging aligns with common CFD industry practices, where brokers attempt to offer alternative cost structures depending on whether users prefer spread-based pricing or commission-based pricing.

Leverage and Execution Messaging

The platform emphasizes fast execution, deep liquidity, and leverage up to 1:500. These statements outline COF’s intended trading conditions framework, but without additional supporting disclosure, traders cannot easily evaluate how these claims translate into real execution quality. In practice, order speed, slippage, and spread consistency usually depend on the broker’s execution model, liquidity arrangements, and risk controls, which are not clearly detailed through the available information.

Regulation Claims and Public Verification Gaps

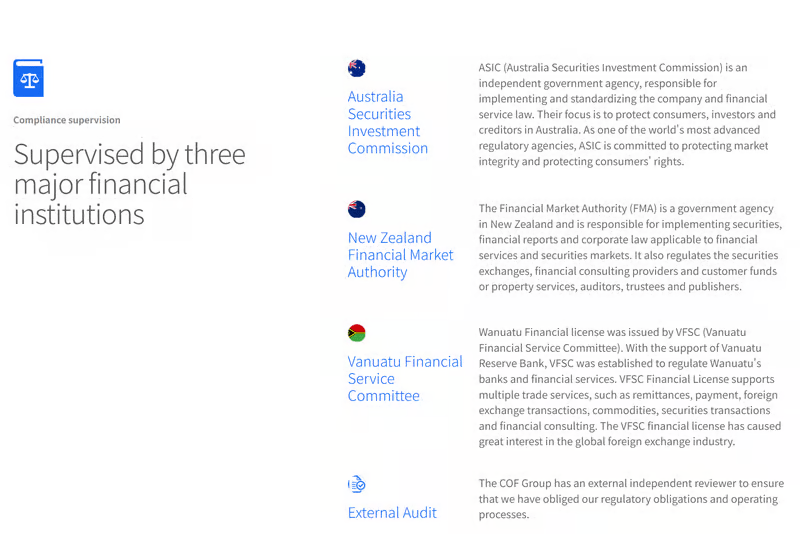

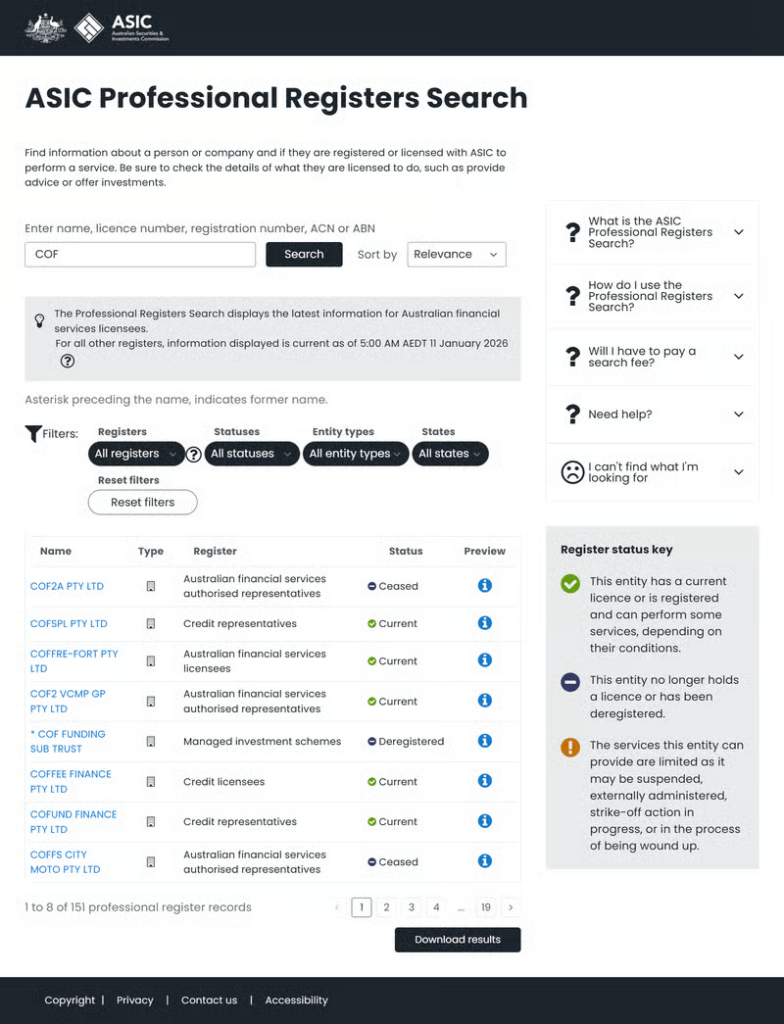

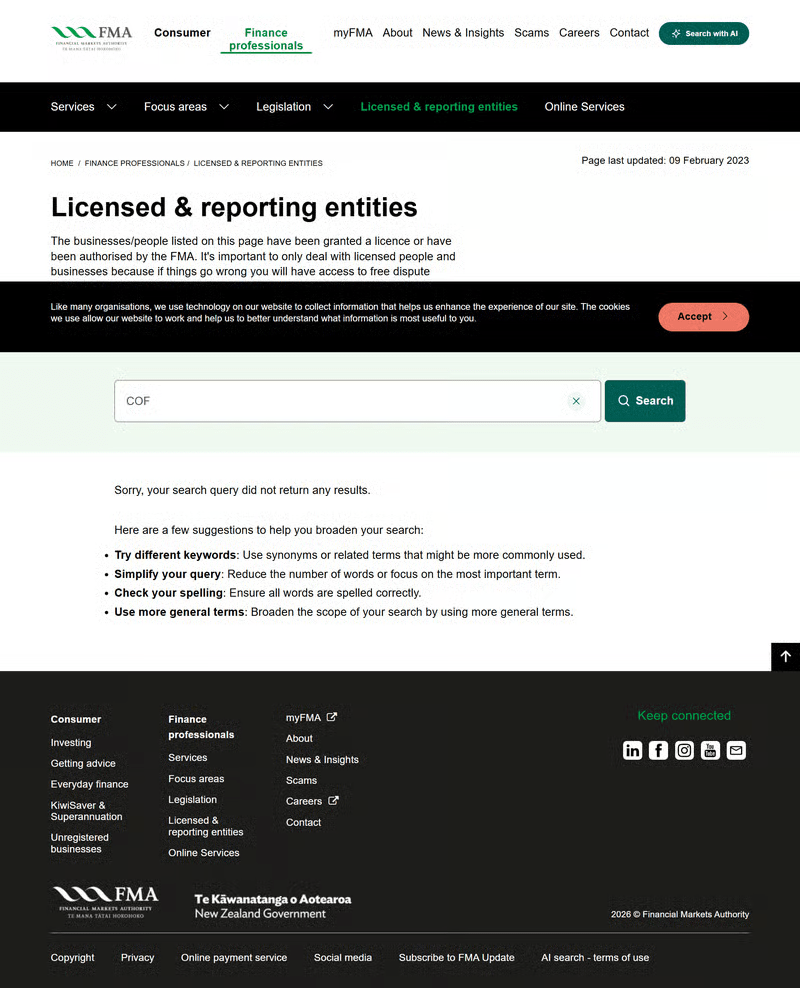

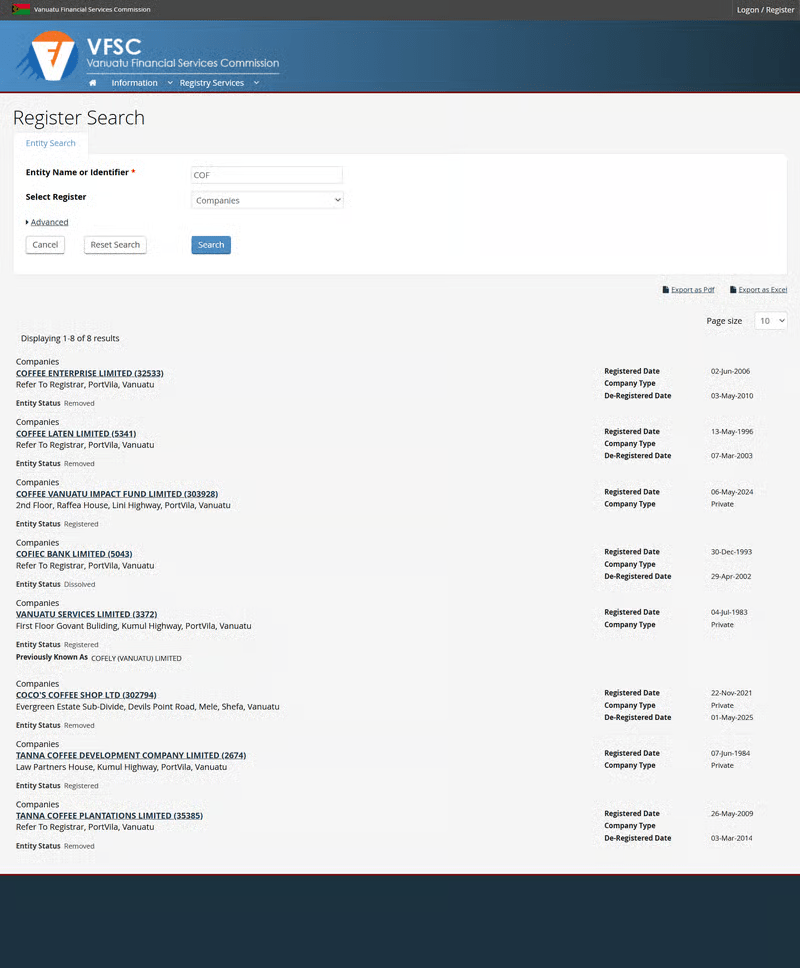

Regulators Listed by COF

COF states on its website that it is regulated by ASIC in Australia, FMA in New Zealand, and VFSC in Vanuatu. These names carry weight in the retail trading market, particularly ASIC and FMA, which are commonly associated with stricter oversight compared to offshore jurisdictions.

Verification Result: No Matching Records Found

During public database checks, the TraderKnows team did not locate registration or regulatory records for COF under the official databases of the regulators named on the platform. When a broker claims oversight by major regulators but does not appear in those public registers, the compliance status becomes difficult to confirm, and the regulatory statements remain unsupported by independently verifiable evidence.

Corporate Transparency and Contact Disclosure

Limited Company Information on the Website

COF’s customer support section indicates that service is available 24/7, but the website does not provide clear contact channels such as a public support email, a phone number, or an official ticket system entry. The platform also does not publicly disclose a headquarters address or a company registration location, which reduces the amount of corporate identity information users can verify.

Why Missing Disclosure Increases User Uncertainty

Corporate transparency is not a minor detail in online trading. When contact pathways and legal entity information are not clearly presented, users may have difficulty understanding who is responsible for handling disputes, where complaints should be escalated, or which jurisdiction applies if withdrawal delays, account conflicts, or policy disagreements occur.

External Visibility and Social Presence

No Verified Social Media Channels Found

No official COF accounts were identified on major social media platforms during checks. This suggests that COF’s public activity footprint on third-party channels is minimal, and that the platform relies primarily on its own website for external communication and branding.

Why Third-Party Visibility Can Be a Useful Reference

A social media presence is not proof of compliance, but it often provides supporting signals about operational continuity. Platforms that actively serve users typically leave behind consistent external traces such as updates, support interactions, announcements, and publicly visible engagement. When those signals are absent, it becomes more difficult to assess brand activity beyond the platform’s self-published content.

Educational Content and Beginner Support

Learning Tools Provided on the Website

COF has built an education section containing basic learning materials focused on forex market concepts, introductory technical and fundamental analysis explanations, and general coverage of forex and CFD features. The platform also offers a Forex Glossary that explains common terms, providing reference content that may help beginners understand basic trading vocabulary.

Practical Limits of Entry-Level Materials

Beginner content can be useful as a starting point, but its real value depends on depth and usability. Traders typically benefit more from education that includes real examples, risk scenarios, and structured learning paths rather than only short definitions and general explanations. From the available descriptions, COF’s educational content appears positioned as foundational reference rather than comprehensive trader training.

Deposits, Withdrawals, and Payment Rules

Supported Funding Methods

COF lists PayPal, Neteller, and Skrill as supported deposit and withdrawal options. The platform states that withdrawals must be returned to the same account used for the initial deposit, which is a common rule in many payment systems designed to support transaction traceability.

Processing Speed and Fee Statements

COF claims withdrawals are completed instantly after processing and that no additional fees are charged. In real-world usage, withdrawal speed often depends on internal review steps, verification processes, and payment channel timelines, so traders typically look for clear details about expected processing windows, identity verification requirements, and any limits by method.

Partnership Incentives and Promotional Strategy

Brokerage Rewards as a Growth Driver

COF advertises a Brokerage Rewards program that includes bonuses up to $2,500 and referral incentives up to $20,000. These figures indicate that partner-based growth is an important part of the platform’s expansion strategy, encouraging users to promote the platform in exchange for rewards.

What Users Should Understand About Incentive Programs

High-value bonus structures can be legitimate marketing tools, but they also often come with specific conditions such as turnover requirements, eligibility rules, and restrictions on withdrawal of reward funds. If such details are not presented clearly, participants may face misunderstandings about how bonuses are earned, whether they are immediately accessible, or what activity thresholds apply.

Website Traffic Signals and Public Reach

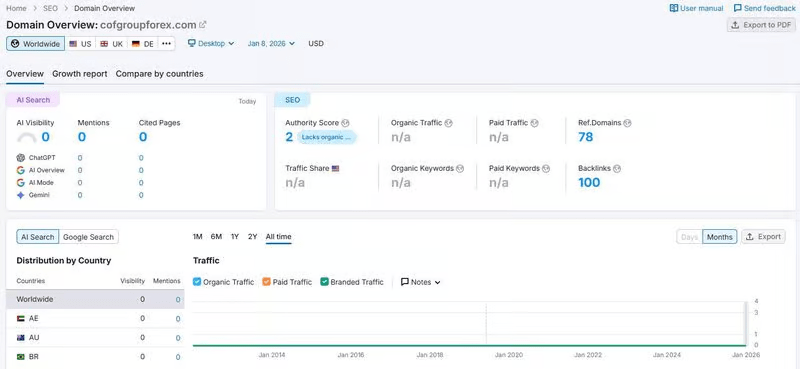

Semrush Indicates Minimal Observable Activity

Semrush data shows an estimated average monthly traffic of 0 for cofgroupforex.com. While traffic tools are not perfect and may miss certain private or direct visit patterns, this metric still suggests that the platform currently has limited measurable visibility and reach through public channels.

How to Interpret This as a Market Signal

Low third-party traffic can reflect early-stage operations, weak search presence, or limited user scale. When a platform claims broad market coverage but shows minimal visible traffic footprint, it may indicate that its public adoption is still small, or that its growth is mainly driven by private referrals rather than open market demand.

Overall Exposure Conclusion

COF presents a recognizable multi-asset trading narrative supported by multi-terminal access, a listed education section, and e-wallet funding options. At the same time, its short domain history, limited corporate disclosure, minimal third-party visibility, and regulation claims that could not be verified through official public databases create a noticeable information gap for users attempting to assess credibility. For traders evaluating COF, the most practical next step is to prioritize independent verification of regulatory status, confirm platform identity disclosures, and review funding and withdrawal policies in detail before placing meaningful capital at risk.

COF FAQ

Q1: What is COF?

COF is an online trading platform that presents itself as a multi-asset service offering access to markets such as forex, commodities, indices, digital currencies, and futures.

Q2: When was COF’s website domain registered?

According to Whois results, cofgroupforex.com was registered on July 30, 2024, and updated on July 31, 2025.

Q3: What products does COF say it supports?

COF states it provides a multi-asset trading structure including forex, commodities, indices, digital currencies, and futures-style instruments.

Q4: What trading platform does COF use?

COF lists ST5 as its main trading platform and indicates support for Windows, Mac, Android, and iOS devices.

Q5: Does COF provide MetaTrader 5 (MT5)?

The website mentions MT5, but the wording appears to describe feature similarity rather than confirming official MT5 system access.

Q6: Is COF regulated?

COF claims regulation by ASIC, FMA, and VFSC. However, public verification checks did not find corresponding records in those regulators’ databases at the time of review.

Q7: Does COF provide clear company contact details?

The platform mentions 24/7 support availability, but specific contact details such as a public email, phone number, or company address are not clearly disclosed.

Q8: What deposit and withdrawal methods are listed?

COF states it supports PayPal, Neteller, and Skrill, and indicates withdrawals must return to the same account used for deposits.