Bitcoin prices stabilized after recent volatility, supported by steady inflows into spot Bitcoin exchange-traded products. Institutional participation helped cushion downside pressure, even as retail trading activity remained cautious. The market response suggests growing maturity in how digital assets absorb macro and regulatory developments.

Background Context

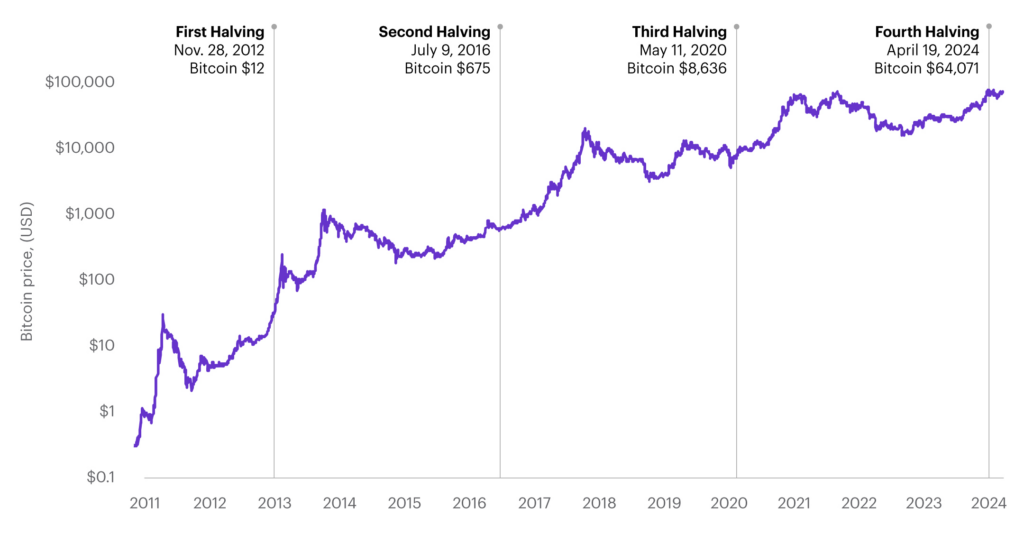

Bitcoin has evolved significantly from its early days as a niche digital experiment. In recent years, it has increasingly attracted institutional interest, particularly following the approval and expansion of regulated investment vehicles. These products allow investors to gain exposure without directly holding the asset, broadening Bitcoin’s appeal.

At the same time, the crypto market remains sensitive to macroeconomic conditions, including interest rates and liquidity. Periods of tightening financial conditions have historically weighed on speculative assets, while easing cycles tend to revive risk appetite.

Why This News Matters

Bitcoin’s ability to stabilize during periods of uncertainty is a notable shift from its historically volatile behavior. Institutional inflows provide a more consistent demand base, potentially reducing extreme price swings over time.

For the broader crypto ecosystem, this trend supports the narrative that digital assets are gradually integrating into traditional financial markets. While volatility has not disappeared, it is increasingly influenced by macro factors rather than purely speculative cycles.

For investors, this means Bitcoin is no longer just a high-risk, high-reward trade. It is increasingly viewed as an alternative asset with distinct drivers, requiring the same level of macro awareness applied to equities or commodities.

Our Expert Take

We believe Bitcoin’s current consolidation phase reflects a market in transition. Institutional participation is improving liquidity and resilience, but it also ties Bitcoin more closely to global financial conditions. This reduces the likelihood of explosive rallies driven solely by retail speculation, but it also lowers the risk of sharp collapses.

Looking forward, Bitcoin’s performance will depend on the balance between macro liquidity trends and continued adoption. Regulatory clarity and sustained institutional interest could support gradual appreciation, while aggressive tightening or adverse policy developments would remain key risks.

For traders and investors alike, Bitcoin now demands a more disciplined approach. Understanding macro correlations and risk management is increasingly important, as the asset behaves less like a fringe instrument and more like an emerging component of the global financial system.