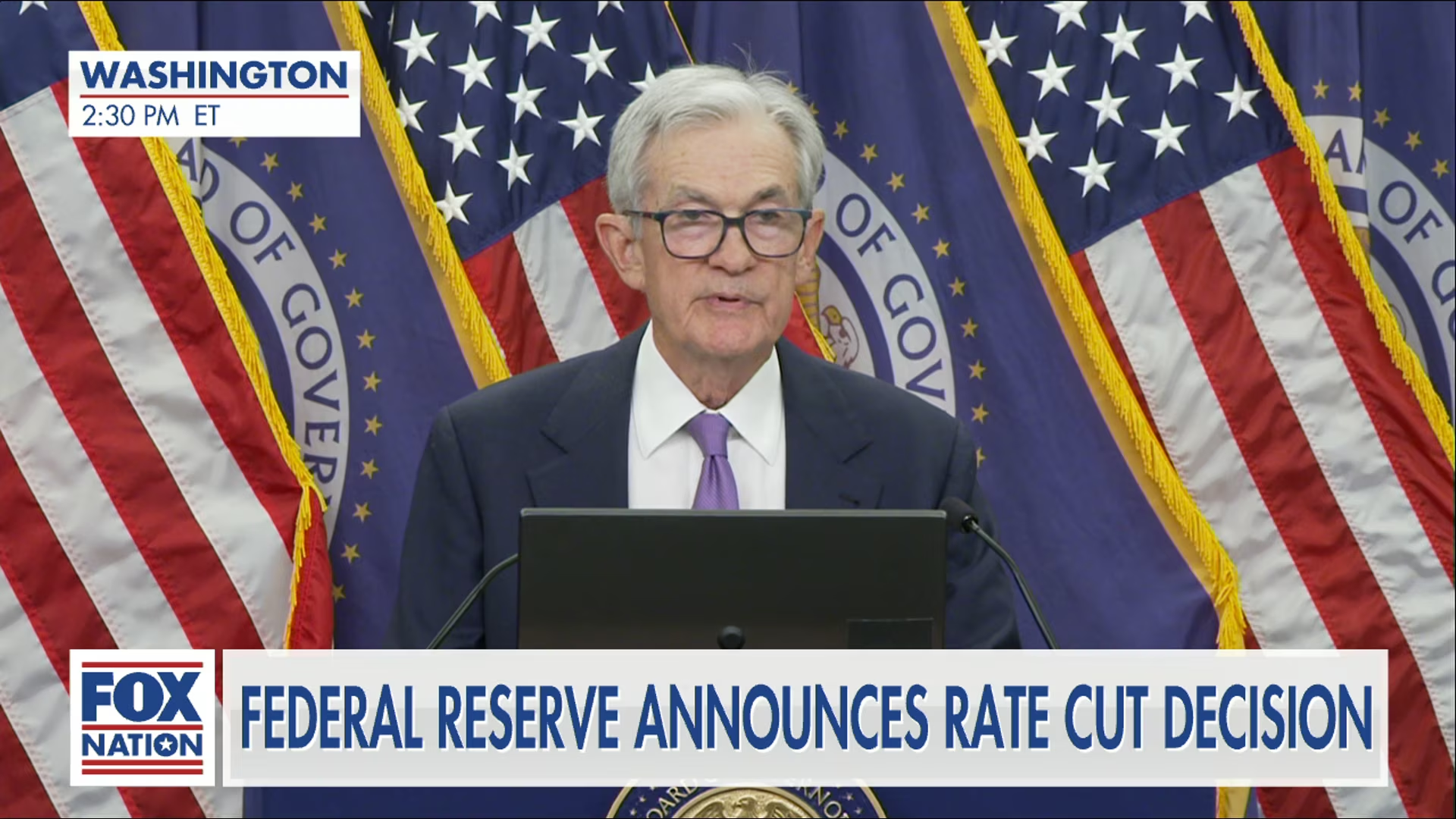

The US dollar weakened broadly this week as investors adjusted expectations around the timing and scale of potential interest rate cuts by the Federal Reserve. The dollar index (DXY) slipped against major peers, while currencies such as the euro and British pound gained modest ground. The move followed softer US inflation signals and cautious commentary from Fed officials, prompting traders to reassess the outlook for US monetary policy in the coming quarters.

Background Context

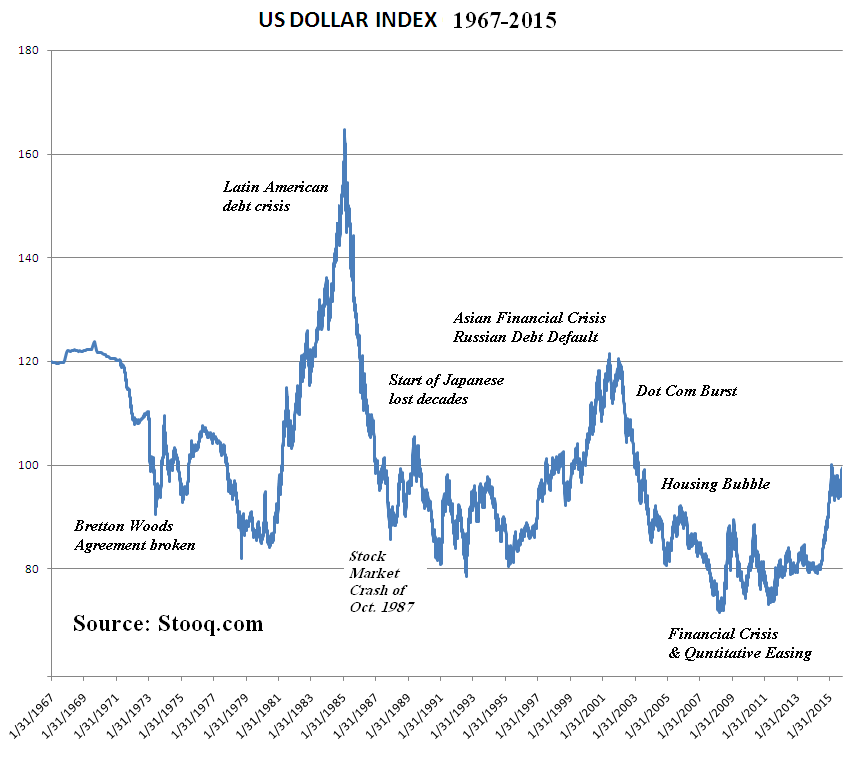

For most of the past year, the US dollar has been supported by relatively high interest rates and resilient economic data. The Fed’s aggressive tightening cycle, aimed at controlling inflation, pushed benchmark rates to multi-year highs and attracted global capital flows into dollar-denominated assets.

However, recent economic indicators have shown signs of cooling. Inflation readings have moderated compared to last year’s peaks, while labor market data suggests gradual normalization rather than overheating. At the same time, other major central banks, including the European Central Bank and the Bank of England, are approaching the later stages of their own tightening cycles, narrowing interest rate differentials that previously favored the dollar.

Against this backdrop, currency markets have become increasingly sensitive to any signal suggesting that the Fed may pivot toward easing sooner than expected.

Why This News Matters

The US dollar sits at the center of the global financial system, influencing everything from international trade to commodity prices and emerging market capital flows. Even modest shifts in dollar strength can have outsized effects across asset classes.

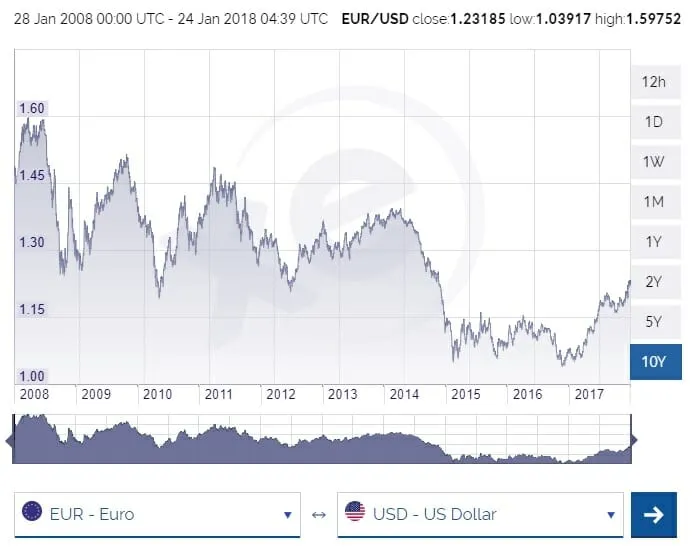

For forex traders, a softer dollar environment can create opportunities in major pairs such as EUR/USD and GBP/USD, as well as higher-beta currencies that tend to benefit when US yields fall. For global investors, dollar weakness can improve financial conditions abroad by reducing the burden of dollar-denominated debt.

This repricing of rate expectations also highlights how finely balanced the market narrative has become. Rather than reacting to a single data point, investors are increasingly focused on the trajectory of inflation and growth. Any surprise—either a reacceleration in prices or an unexpected slowdown—could quickly reverse current sentiment.

From a macro perspective, the dollar’s pullback suggests that markets are shifting from a “higher for longer” mindset to a more nuanced view in which rate cuts are plausible but not guaranteed.

Our Expert Take

From our perspective, the recent dollar weakness reflects positioning and expectations more than a decisive trend reversal. While inflation has cooled, it remains above the Fed’s long-term target, giving policymakers limited room to declare victory prematurely.

In the near term, we expect the dollar to remain range-bound rather than entering a sustained downtrend. Much will depend on upcoming inflation releases and labor market data, as well as how clearly Fed officials communicate their tolerance for economic softness. If rate-cut expectations move too far ahead of reality, the market may be forced to recalibrate again.

For traders, this environment favors flexibility over conviction. Short-term tactical trades may outperform long-term directional bets until there is clearer evidence that US monetary policy is decisively shifting. Investors should also monitor global risk sentiment closely, as periods of market stress still tend to support the dollar regardless of rate expectations.