MFXTECH promotes itself as a fintech-oriented investment platform offering multi-asset CFD trading services in a secure and professional environment. While its public messaging emphasizes technology, expertise, and regulatory alignment, a review of publicly available information reveals several inconsistencies. These include unverifiable UK registration details, unsupported regulatory claims, minimal online visibility, and a lack of disclosure regarding trading conditions. This report examines MFXTECH’s corporate background, regulatory assertions, website operations, and user-facing transparency to assess potential risks for investors.

Platform Positioning and Corporate Claims

Self-Described Business Model

MFXTECH describes its mission as creating a convenient and secure investment environment by combining technical infrastructure, professional experience, and regulatory standards. The platform claims to provide fund management and CFD-based trading services across global markets.

According to its own description, the team behind MFXTECH includes traders, analysts, developers, and cybersecurity specialists, with support services available around the clock. Such positioning is common within the online trading industry, particularly among platforms seeking to appeal to international retail investors. However, these claims rely heavily on external verification to establish credibility.

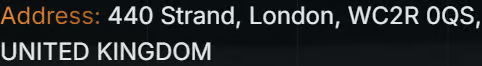

Declared UK Address

The platform lists an address at 440 Strand, London WC2R 0QS, United Kingdom. While the inclusion of a London address may suggest a UK presence, an address alone does not confirm legal incorporation or operational legitimacy within the jurisdiction.

Registration and Regulatory Verification Review

UK Corporate Registration Status

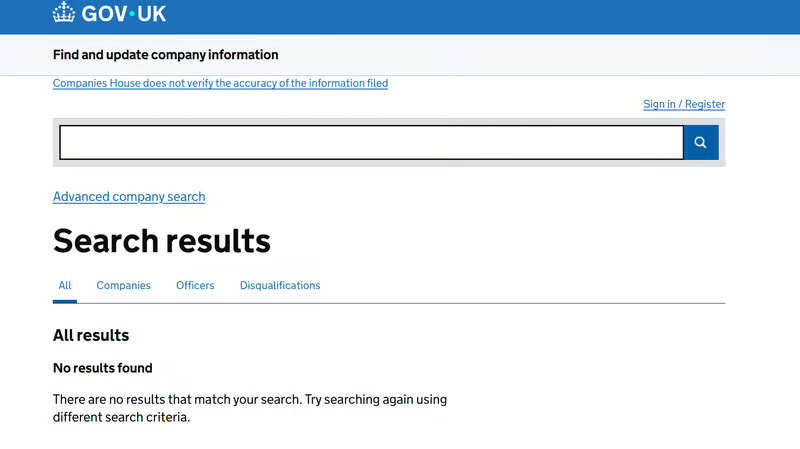

A search conducted through Companies House does not show any registered entity corresponding to MFXTECH at the stated address. No matching company name or registration number appears in the official UK corporate database.

The absence of a Companies House record indicates that MFXTECH does not appear to be incorporated as a UK company, despite presenting itself with a UK-based address. This gap makes it difficult to determine the platform’s legal entity, ownership structure, or jurisdiction of operation.

FCA Authorization Claims

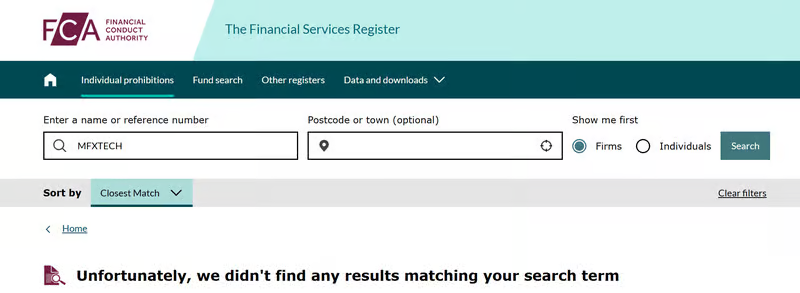

MFXTECH states that it is authorized by the Financial Conduct Authority. However, a review of the FCA’s official Financial Services Register does not return any licensed firm or authorization number associated with the MFXTECH name.

From a regulatory standpoint, this means the platform’s claimed FCA status cannot be independently verified. Without confirmation in the official register, the investor protections typically associated with FCA-regulated firms, such as oversight standards and dispute resolution mechanisms, may not apply.

Domain History and Website Activation Timeline

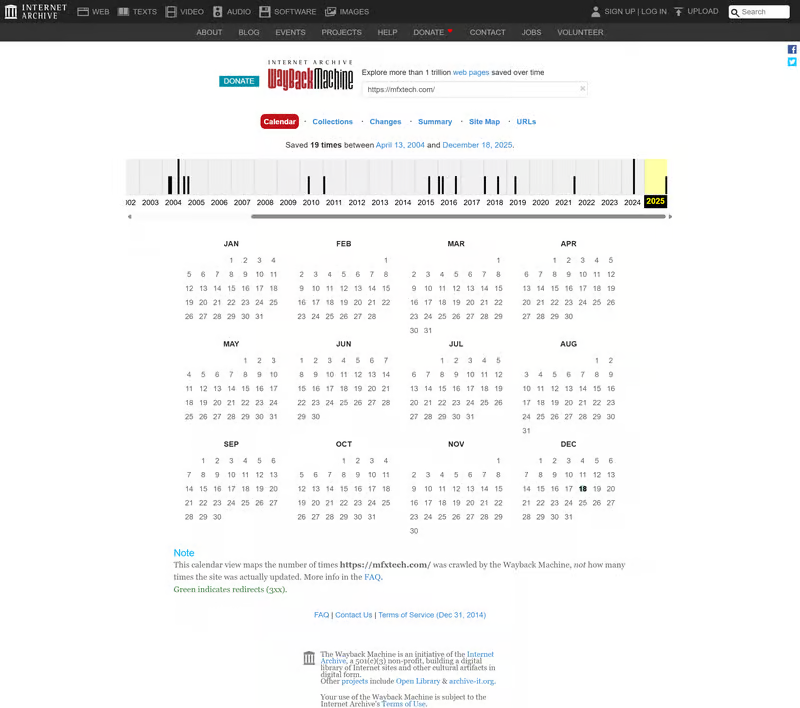

WHOIS and Archive Analysis

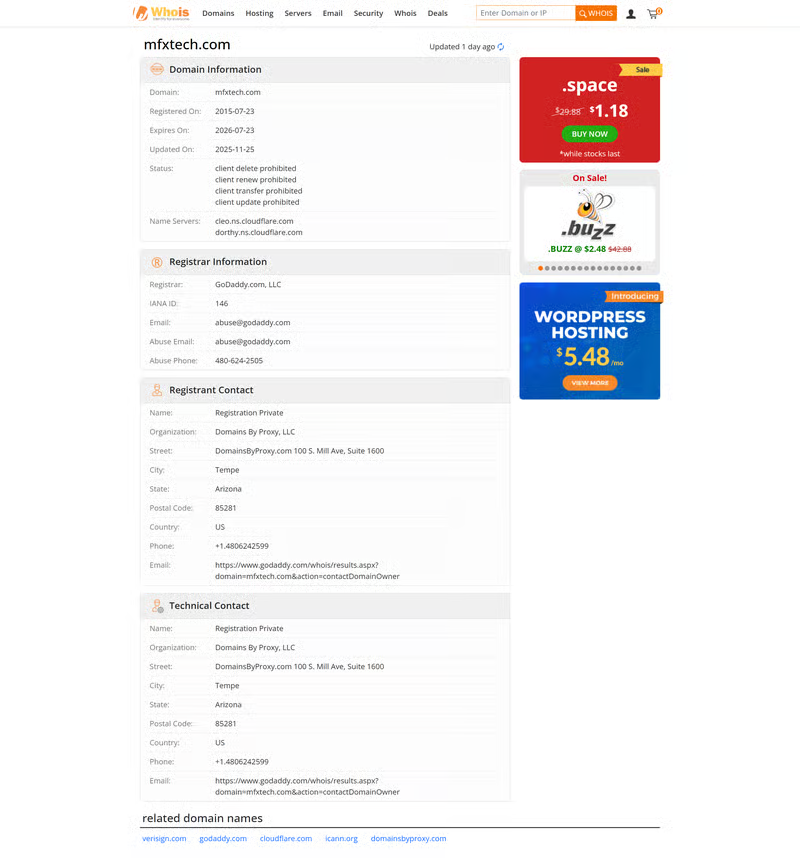

Domain registration records indicate that mfxtech.com was first registered in July 2015 and later updated in November 2025. However, historical snapshots from the Wayback Machine show that content explicitly related to MFXTECH did not appear until December 2025.

This discrepancy suggests a significant gap between domain registration and active platform use. Such patterns are not uncommon in cases where domains are held inactive for long periods or repurposed for new projects, but they reduce the value of domain age as an indicator of operational history.

Market Visibility and Traffic Performance

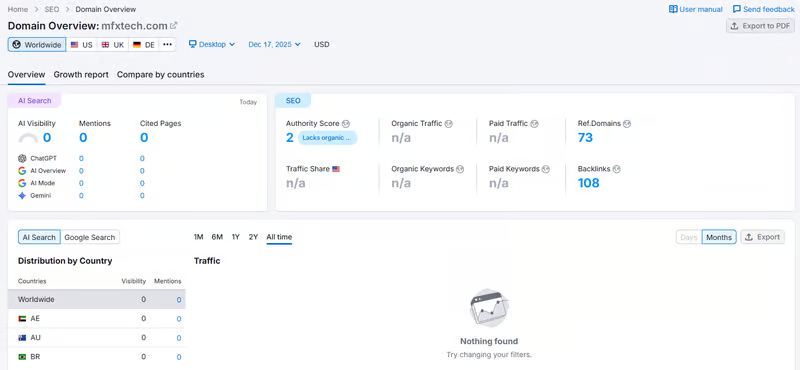

SEMrush Data Overview

Traffic analysis data shows that mfxtech.com currently has an Authority Score of 2 and records no organic traffic, paid traffic, or keyword rankings. Despite the presence of some backlinks and referring domains, the site shows no measurable visitor activity across regions.

This lack of traffic suggests that MFXTECH has minimal online visibility and limited engagement from the broader trading community. While low traffic alone does not prove misconduct, it does indicate that the platform has not established a meaningful public footprint.

Trading Products and Disclosure Quality

Advertised Trading Instruments

MFXTECH states that it offers CFD trading across forex, stocks, indices, cryptocurrencies, and commodities. The product range appears broad and aligns with typical multi-asset CFD platforms, covering major currency pairs, popular indices, precious metals, energy products, and mainstream digital assets.

Undisclosed Trading Infrastructure

Despite listing tradable instruments, MFXTECH does not publicly disclose whether it uses established platforms such as MT4 or MT5, or whether it operates a proprietary trading system. There is also no publicly available information on execution methods, liquidity sources, or order processing models.

Without these details, users cannot independently assess trading quality, platform stability, or execution reliability.

Account Structure and Trading Conditions

Lack of Account-Level Transparency

Public materials do not specify account types, minimum deposit thresholds, leverage limits, spreads, or commission structures. These elements are central to understanding actual trading costs and risk exposure.

The absence of such disclosures limits users’ ability to make informed comparisons with other platforms and evaluate whether the trading environment aligns with their risk tolerance and strategy.

Communication Channels and Public Presence

Customer Support Methods

MFXTECH lists Telegram-based support and an email address as its primary communication channels. While these methods allow direct contact, they are relatively limited for a platform presenting itself as a professional fintech service provider.

Absence of Social Media Channels

No official or verified social media accounts associated with MFXTECH have been identified. This limits transparency around announcements, operational updates, and community engagement, which are commonly used by established brokers to communicate with users.

User Feedback and Reported Issues

Review Platform Observations

User reviews available on Trustpilot show a small sample size with polarized ratings. While some reviews are positive, at least one negative review raises concerns related to withdrawal procedures, including requests for additional payments described as taxes before funds could be released.

Such claims cannot be independently confirmed, but they align with commonly reported warning signs in high-risk online trading environments.

Website Usability and Registration Experience

Interface and Navigation Assessment

From a technical perspective, the website demonstrates clear content categorization, logical navigation structure, and relatively fast page loading speeds. These factors contribute to a smooth browsing experience.

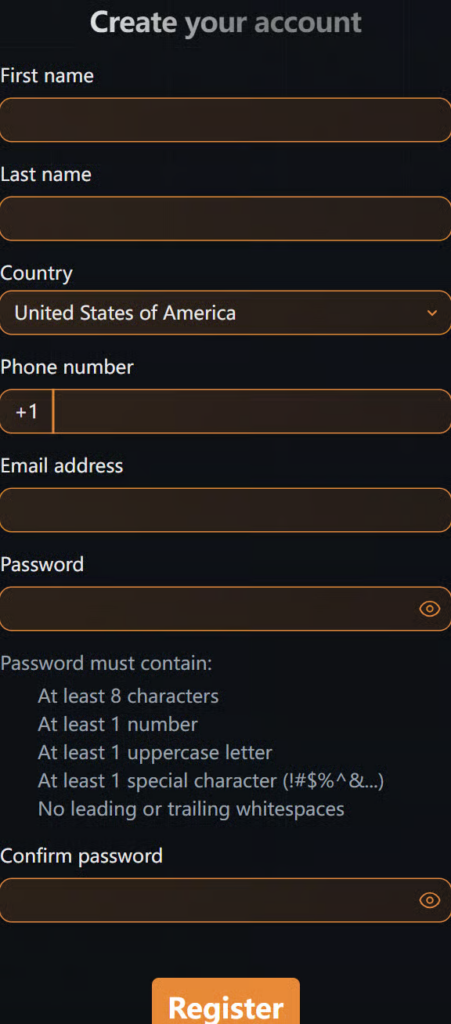

Registration Form Design

The registration process is simple and intuitive, with clearly labeled fields and minimal steps. While this reduces friction for new users, ease of onboarding combined with limited regulatory clarity may increase risk for inexperienced traders who register without conducting sufficient due diligence.

Conclusion and Risk Perspective

MFXTECH presents a polished front-end experience and a broad range of CFD products, but critical gaps remain in verifiable registration, regulatory confirmation, and disclosure of trading conditions. The lack of confirmed FCA authorization, absence of a UK corporate record, minimal market visibility, and limited transparency around operations collectively represent notable risk signals.

Investors considering engagement with the platform should exercise heightened caution, seek independent verification, and avoid committing funds without clear evidence of regulatory oversight and contractual clarity.

MFXTECH FAQ

What is MFXTECH?

MFXTECH is an online trading platform offering contracts for difference across multiple asset classes, including forex, commodities, indices, cryptocurrencies, and stocks.

Is MFXTECH regulated?

MFXTECH claims authorization by the UK Financial Conduct Authority, but no matching record or authorization number has been found in the official FCA register.

Is MFXTECH registered in the UK?

Although the platform lists a London address, no corresponding company registration for MFXTECH appears in the UK Companies House database.

What trading instruments does MFXTECH offer?

The platform advertises CFD products covering major currency pairs, global indices, commodities, precious metals, and mainstream cryptocurrencies.

Does MFXTECH disclose its trading platform and fees?

Public information does not clearly specify the trading software used, account types, minimum deposits, spreads, or commission structures.

How can users contact MFXTECH?

The platform provides contact through email and a Telegram support channel for customer inquiries and technical assistance.

Are there user reviews of MFXTECH?

A limited number of user reviews are available online, showing mixed feedback, including some concerns related to withdrawal procedures.