Vexton Markets presents itself as a global online CFD trading platform established in 2020 and headquartered in Canada, offering forex, gold, and oil trading services. While the platform promotes technological innovation, social trading, and copy trading features, publicly available information reveals multiple gaps in corporate registration, regulatory disclosure, operational transparency, and online presence. This report consolidates available data to examine Vexton Markets’ background, website footprint, regulatory standing, and service disclosures.

Platform Background and Claimed Positioning

Company Profile

Vexton Markets is introduced as an online forex and CFD trading platform founded in 2020, with a stated headquarters in Toronto, Canada. According to its own descriptions, the platform focuses on accessibility and user engagement by combining real-time trading accounts with educational resources and advanced trading tools.

The platform claims to serve users across multiple regions worldwide and emphasizes features such as social trading and copy trading to lower the entry barrier for retail traders.

Core Trading Offerings

Vexton Markets states that it provides contract for difference (CFD) trading services covering:

- Foreign exchange (Forex)

- Gold CFDs

- Oil CFDs

The product range is relatively narrow and primarily focused on major and commonly traded asset classes, without reference to indices, equities, or cryptocurrencies.

Website and Domain Registration Analysis

Domain Registration Timeline

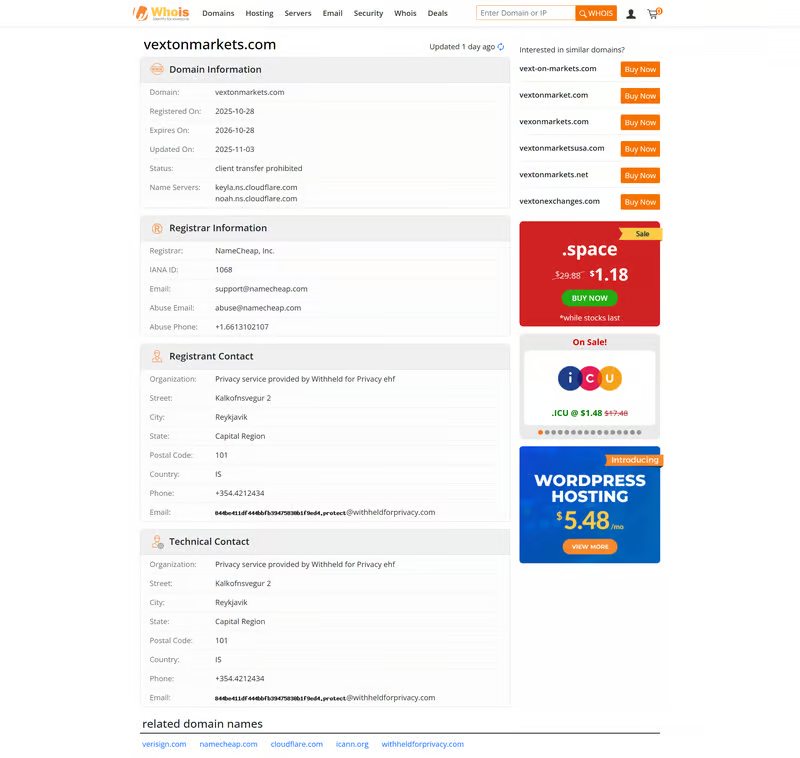

According to publicly accessible WHOIS records, the official website domain vextonmarkets.com shows the following timeline:

- Initial registration date: October 28, 2025

- Last update date: November 3, 2025

Observations on Domain History

The very recent registration and short operational history of the domain indicate that the website is still in its early stage of existence. Such a limited domain lifespan provides little historical data regarding platform continuity, user adoption, or long-term operational behavior.

Corporate Registration Verification

Ontario Business Registry (OBR) Check

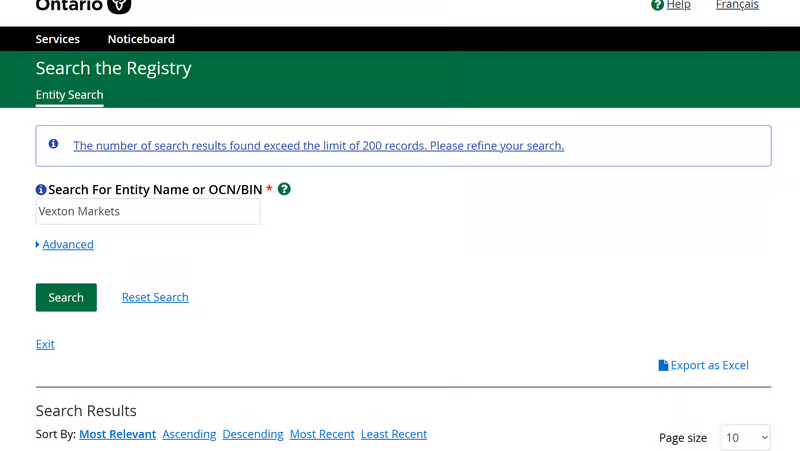

Vexton Markets lists a Canadian address in Ontario as its business location. However:

- No matching entity records were found in the Ontario Business Registry (Corporate Register) under the platform’s stated name.

Implications

For platforms claiming Canadian headquarters, the absence of verifiable corporate registration raises questions regarding the legal establishment of the operating entity within the jurisdiction.

Regulatory Disclosure Review

Stated Regulatory Status

Vexton Markets does not publish any regulatory license numbers, supervising authorities, or compliance statements on its official website.

CSA (Canadian Securities Administrators) Database Search

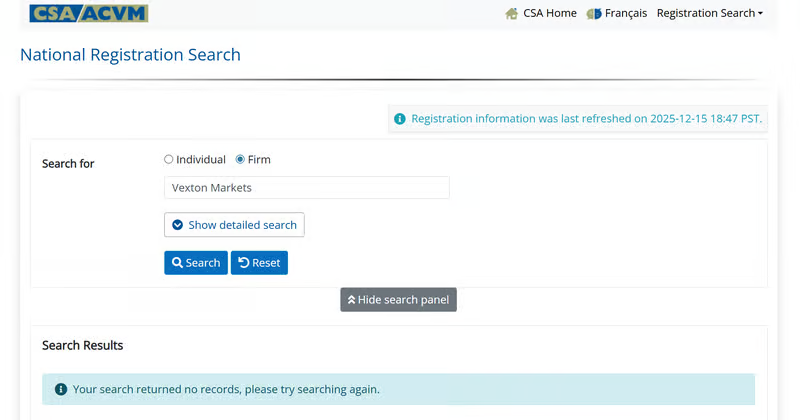

Based on the platform’s declared address and business scope:

- No corresponding regulatory authorization or registration records were found in the Canadian Securities Administrators (CSA) database.

Regulatory Transparency Assessment

The lack of disclosed regulatory information and absence from relevant Canadian regulatory databases suggest that users are unable to independently verify whether the platform operates under any recognized financial supervision.

Website Traffic and Online Visibility

SEMrush Traffic Data Snapshot

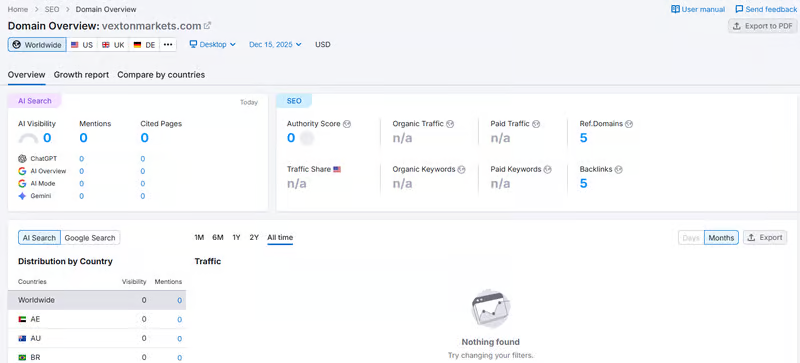

According to SEMrush analytics:

- Authority Score: 0

- Organic search traffic: None detected

- Keyword rankings: None

- Backlinks: Minimal and limited in number

Interpretation

These indicators reflect extremely low online visibility and minimal discoverability through search engines. For a platform targeting international markets, such limited digital presence is uncommon and restricts external validation through user reviews or third-party analysis.

Trading Platform and Technology Claims

TM9 Mobile Trading Application

Vexton Markets claims to operate a proprietary mobile trading solution known as the TM9 trading app, with support for both:

- iOS systems

- Android systems

The platform promotes features such as:

- Integration with TradingView

- Fast trade execution

- AI-driven market analysis

- Automated trade tracking

The app is reportedly available through mainstream application stores, although no detailed technical documentation or third-party audits are publicly provided.

Account Structure and Trading Conditions

Lack of Public Disclosure

At the time of review, Vexton Markets does not publicly disclose:

- Account type classifications

- Spread or commission structures

- Minimum deposit requirements

- Leverage ratios

- Margin policies

Impact on User Evaluation

Without transparent trading condition disclosures, prospective users cannot effectively compare costs, risks, or suitability relative to other CFD platforms.

Contact Details and Operational Transparency

Registered Address

The platform publicly lists the following address:

Vexton Markets Trading Inc.

450 King Street West, Suite 1200

Toronto, Ontario M5V 1L7

Canada

Available Communication Channels

The only disclosed contact method is:

- Email: [email protected]

No public information is provided regarding:

- Telephone support

- Live chat services

- Customer service operating hours

Social Media Presence Review

Absence of Official Accounts

As of the latest review:

- No verified or official social media accounts associated with Vexton Markets were identified.

Market Norm Comparison

For online trading platforms targeting global users, social media channels often serve as key communication and brand transparency tools. The absence of such channels limits access to real-time updates, community feedback, and external engagement signals.

Concluding Observations

Based on currently available public information, Vexton Markets displays several characteristics of an early-stage or minimally disclosed online trading platform. These include a newly registered domain, lack of verifiable corporate and regulatory records in Canada, minimal online traffic visibility, and limited disclosure regarding trading conditions and operational structure.

This report is intended to present verifiable information for reference and does not constitute financial advice or an assessment of trading outcomes.