Bittam presents itself as a global cryptocurrency trading platform promoting “free trading anytime, anywhere.” However, a closer review shows that the platform is newly established, offers limited operational transparency, relies heavily on marketing claims around MSB registration, and lacks verifiable disclosures regarding its trading system, corporate entity, and user protection mechanisms. Public data, traffic metrics, and social media activity further indicate that Bittam has minimal real-world market presence at this stage.

Platform Overview

Bittam positions itself as a digital asset trading platform focused on cryptocurrency investments. Its website emphasizes cross-device accessibility and mobile trading, offering download links for Android and iOS applications. The platform mainly targets international users, highlighting convenience and flexibility as its core value proposition.

Despite these claims, publicly available information about Bittam’s actual operations, ownership structure, and technical infrastructure remains limited.

Website Establishment and Domain Background

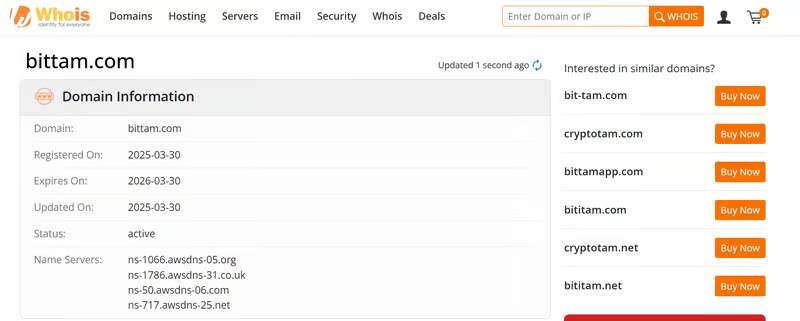

Domain Registration Details

According to Whois records, the domain bittam.com was registered on March 30, 2025, with the last update occurring on the same date. From a timeline perspective, this indicates that the platform is still in its earliest operational phase.

Operational Maturity Assessment

Although the website appears visually complete, its short online history means there is very little third-party data, user feedback, or independent verification available. This lack of historical footprint makes it difficult to assess Bittam’s real trading volume, user activity, or long-term sustainability.

Regulatory Claims and Compliance Status

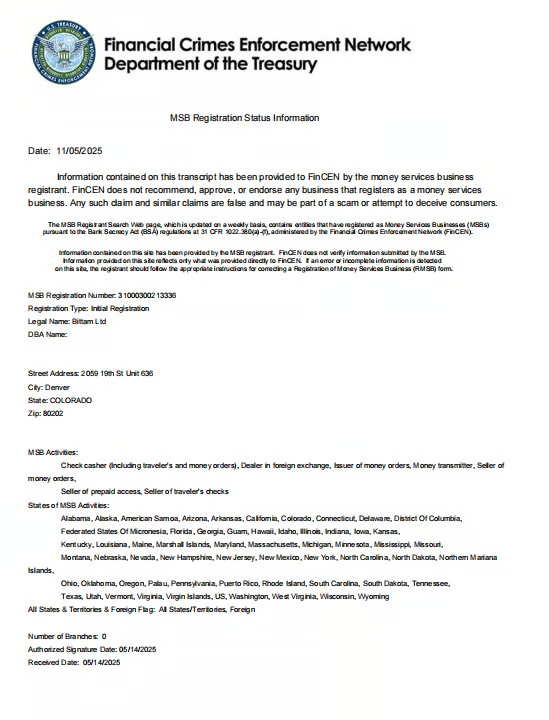

MSB Registration Statement

Bittam claims on its official website that it has obtained an MSB (Money Services Business) license, suggesting compliance with regulatory standards.

Verification Findings

A search of the U.S. Financial Crimes Enforcement Network (FinCEN) database does show a corresponding MSB registration. However, it is critical to clarify the scope and limitations of such registration:

- MSB registration primarily relates to AML (Anti-Money Laundering) and CFT (Counter-Terrorism Financing) compliance.

- The MSB framework covers activities such as money transmission, currency exchange, prepaid value services, and money orders.

- It does not authorize or regulate cryptocurrency exchange matching, derivatives trading, or global investment services.

FinCEN itself explicitly states that MSB registration does not constitute approval, endorsement, or regulatory supervision of a company’s business model. Any implication of regulatory endorsement based on MSB status alone may therefore be misleading.

Trading System and Software Architecture

Multi-Device Trading Concept

Bittam promotes a “trade anytime, anywhere” concept, supporting mobile and potentially desktop access. Download links for its applications are available on both Google Play and the App Store.

Transparency Gaps

Despite these claims, the platform does not publicly disclose:

- Trading interface screenshots

- Order-matching engine specifications

- Server locations or redundancy design

- Encryption standards or cybersecurity architecture

As a result, the transparency level of Bittam’s trading system remains low, making it difficult for users to evaluate execution quality or system reliability.

Supported Trading Assets

Cryptocurrency Coverage

Bittam focuses exclusively on cryptocurrency trading, listing mainstream assets such as:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- Ripple (XRP)

Product Structure Limitations

While trading entry points are displayed, the platform does not clearly disclose:

- Leverage ratios

- Fee schedules

- Liquidation rules

- Risk management or insurance mechanisms

Additionally, all trading margins and profit settlements are uniformly conducted in USDT, regardless of the traded asset. The absence of detailed product parameters suggests that the overall trading framework is still incomplete.

Deposit and Withdrawal Mechanisms

Supported Funding Methods

Bittam allows deposits and withdrawals via cryptocurrencies including BTC, ETH, USDT, and XRP.

Fund Security Claims

The platform states that user funds are stored in cold wallets with multi-signature protection. However, it does not provide evidence of:

- Third-party security audits

- Custodial partnerships

- Proof-of-reserve disclosures

Without independent verification, these security claims remain unsubstantiated.

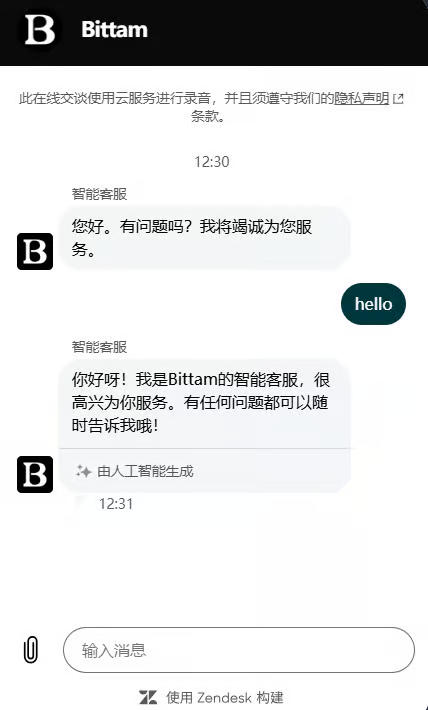

Customer Support and Contact Channels

Available Communication Methods

Bittam lists the following contact options:

- Support email: [email protected]

- Business cooperation email: [email protected]

- On-site live chat system

Transparency Assessment

No phone number, executive contact information, or corporate representatives are disclosed. The live chat system is functional but primarily operates in Chinese, with no clear indication of multilingual support or standardized response timelines.

Overall, the customer support framework appears basic and lacks institutional structure.

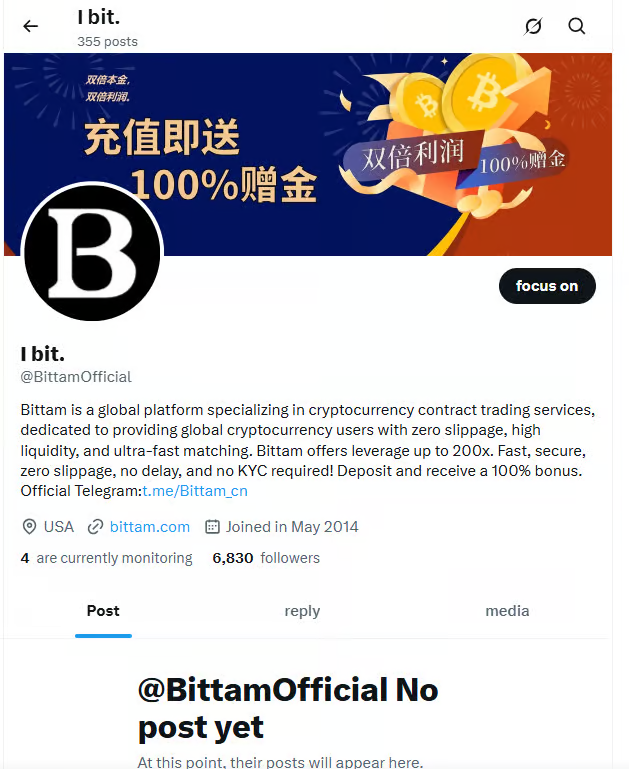

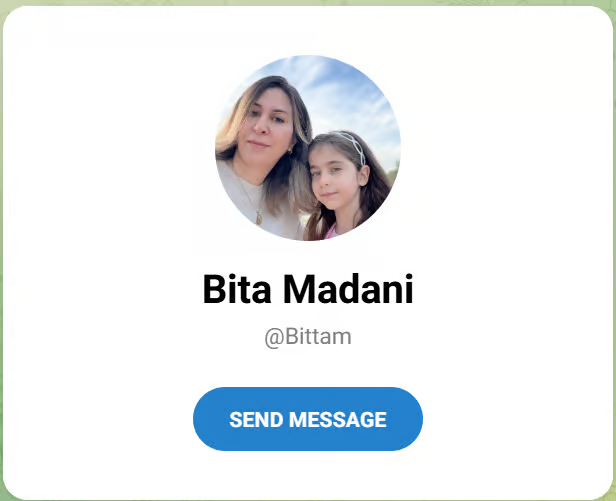

Social Media Presence and Brand Activity

Platform Accounts Overview

Bittam’s social media footprint is notably weak:

- Twitter (@BittamOfficial): Profile exists but contains no posts or engagement.

- Telegram: Displays a personal account name (“Bita Madani”), inconsistent with the brand identity.

- Facebook: Page is accessible but shows no activity or updates.

Brand Consistency Issues

The lack of content, engagement, and brand consistency across social platforms suggests minimal marketing operations and limited user community interaction.

Company Address and Legal Disclosure

Bittam does not disclose:

- A registered company address

- Physical office locations

- Corporate registration certificates

- Management or shareholder information

The absence of basic legal and geographical disclosures makes it difficult to determine the platform’s actual jurisdiction or operational base.

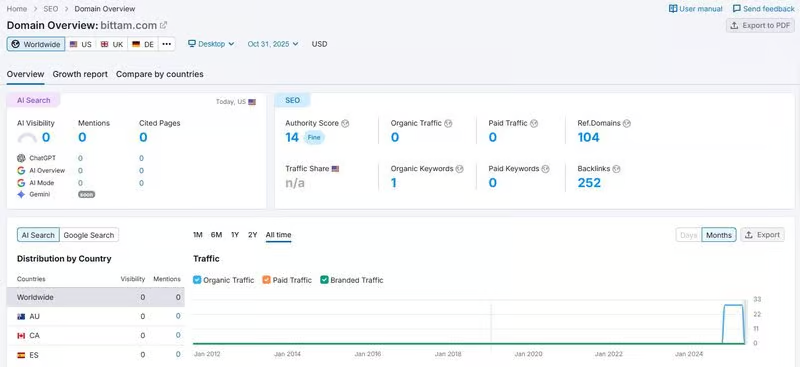

Website Traffic and Market Visibility

Traffic Data Snapshot

According to third-party analytics from Semrush:

- Average monthly visits: 0

- Authority score: 14

- Referring domains: 104

- Backlinks: 252

Despite having some backlinks, the site generates virtually no organic traffic or keyword rankings, indicating extremely low global visibility and user engagement.

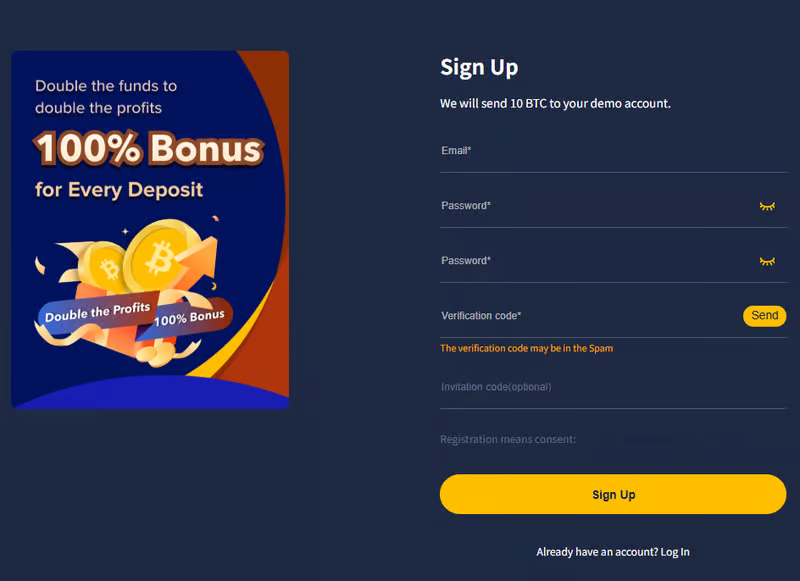

Registration Process Review

Website Structure and Navigation

The website design is minimalistic, with a shallow navigation structure centered around app downloads and account registration. Users can quickly locate entry points, but there is limited explanatory content about trading rules or platform mechanics.

Account Registration Form

The registration process requires basic information such as email, password, and verification code. While the form is easy to complete, it does not clearly explain:

- Data usage policies

- Privacy protection measures

- KYC or identity verification procedures

Educational Resources and User Guidance

Bittam does not provide educational content such as:

- Beginner tutorials

- Market analysis articles

- Risk disclosure guides

- FAQs or video explanations

For inexperienced users, this lack of educational support may increase operational and financial risk.

Customer Support Testing Results

A test of the live chat function shows that it is operational and responsive, though the interface defaults to Chinese. There is no information on service hours, average response times, or escalation procedures. Email remains the only alternative communication channel.

Overall Observation

From domain history and regulatory positioning to traffic data and public engagement, Bittam currently exhibits characteristics of a very early-stage platform with limited transparency. While it promotes regulatory compliance and technical security, key disclosures remain absent, and its real-world operational footprint appears minimal at this time.

FAQ

What is Bittam?

Bittam is an online platform that claims to offer cryptocurrency trading services, primarily focusing on digital asset investment for international users.

When was Bittam established?

According to public domain records, Bittam’s website was registered in March 2025, indicating a relatively short operating history.

Is Bittam regulated?

Bittam states that it is registered as an MSB in the United States. MSB registration relates to AML and reporting obligations and does not represent regulatory approval of trading activities.

What assets can be traded on Bittam?

The platform lists major cryptocurrencies such as Bitcoin, Ethereum, USDT, and Ripple. All settlements are reportedly conducted in USDT.

Does Bittam provide educational resources?

Bittam does not currently offer structured educational materials, tutorials, or market analysis content on its website.