Trastix presents itself as an emerging online trading provider under the slogan “A Trusted Leader,” promising a seamless and professional trading experience. Yet a closer examination reveals major gaps in credibility, operational maturity, and regulatory transparency. In a recent Traderknows report, the platform was flagged for multiple high-risk indicators, making its reliability highly questionable.

Background and Domain Information

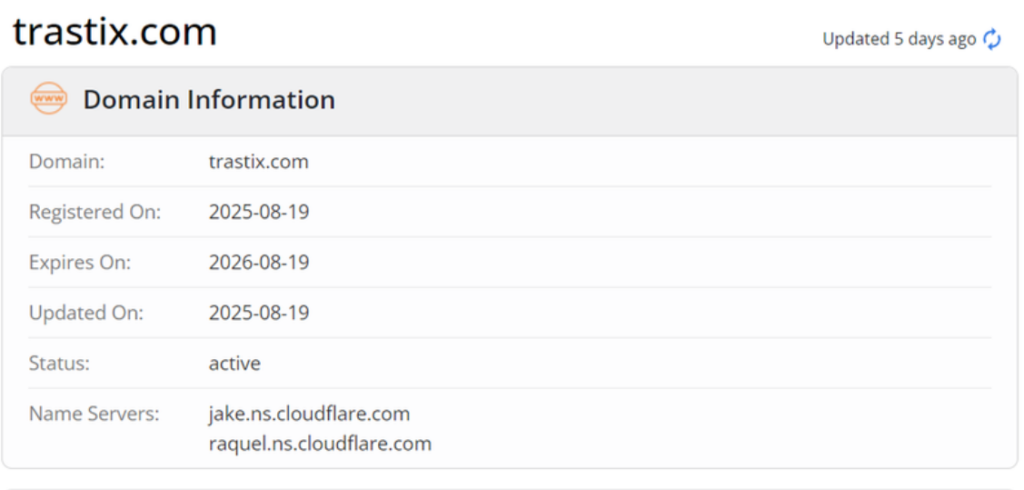

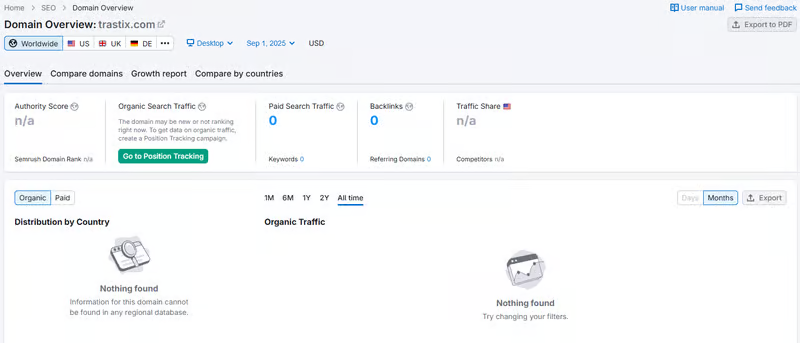

Trastix operates via trastix.com, a domain registered on August 19, 2025, and valid only until August 19, 2026. The registration and last-update dates are identical, showing no ongoing development efforts. Traderknows’ investigation highlights that newly registered domains with such short lifespans often serve as temporary shells, lacking operational history and increasing the likelihood of user risk.

Offered Markets and Products

Market Coverage Claims

The platform states that users can access 4,600 global markets and over 6,400 instruments, including Bitcoin, gold, oil, Apple, and Tesla.

Questionable Volume Figures

Trastix advertises a trading volume of $199 million. However, Traderknows’ analysis found no third-party audits, no verifiable records, and website traffic of under 100 monthly visits, making the volume claim highly improbable. This mismatch raises concerns about data fabrication and misleading marketing.

Trading Platform Features

Platform Capabilities

Trastix describes its system as offering real-time execution, 24/7 accessibility, and a suite of technical and fundamental tools. These features are generic in nature and appear repeatedly across unverified platforms. No independent reviews, user testimonials, or external validations are available to support the platform’s claims.

Security Features vs. Authentic Compliance

The platform lists common security elements—2FA, SSL certificates, monitoring systems, encryption, and firewalls. While these features sound reassuring, Traderknows emphasizes that none of these replace regulatory oversight, which Trastix completely lacks.

No licensing information from agencies such as the FCA, ASIC, CySEC, or NFA is provided, and external checks confirm the absence of any regulatory supervision.

Account Structure

Tiered Account Options

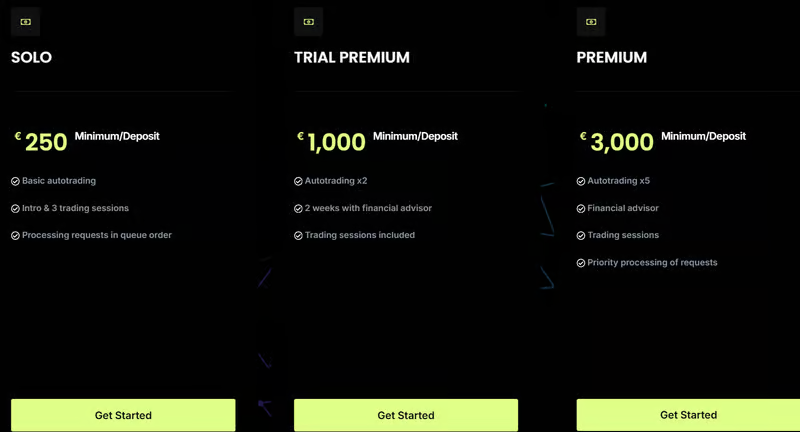

Trastix offers five upgrade-style account types:

- SOLO – €250 minimum

- TRIAL PREMIUM – €1,000 minimum

- PREMIUM – €3,000 minimum

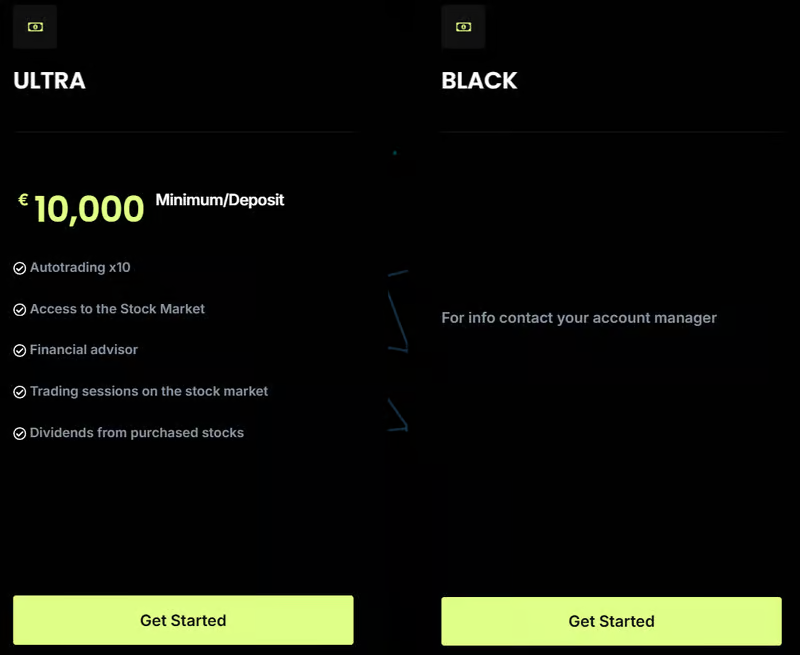

- ULTRA – €10,000 minimum

- BLACK – undisclosed minimum, details only through a manager

Design Concerns

The progressive deposit escalation and private negotiation for the BLACK account align with patterns often seen in high-risk or unregulated platforms. Traderknows notes that legitimate brokers openly disclose account requirements and do not hide deposit thresholds.

Regulatory and Legal Standing

No Licenses or Oversight

Despite presenting itself as a global trading provider, Trastix has no registered licenses from any recognized financial authority.

According to the Traderknows report, the platform operates entirely outside regulated frameworks, meaning:

- No investor protection

- No dispute-resolution mechanisms

- No legal safeguards for client funds

This unlicensed status is a critical risk factor.

Contact Information

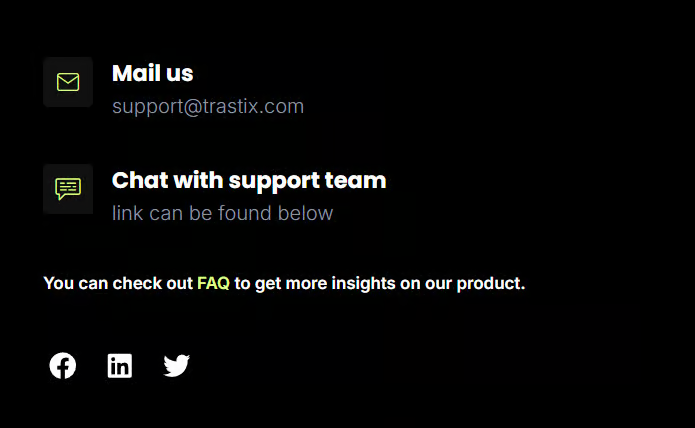

Trastix lists only an email ([email protected]) and a generic chat widget. There is no corporate address, no phone number, and no verified social media accounts. This minimal contact infrastructure is frequently associated with platforms that lack real customer service or operational transparency.

Online Traffic and User Reach

Semrush records show fewer than 100 monthly visits to trastix.com. Traderknows’ coverage highlights the contradiction between this negligible traffic and the platform’s claim of “millions of users,” labeling the statement as misleading.

FAQ – Trastix

1. What is Trastix?

An online trading platform with unverified claims.

2. Is Trastix regulated?

No. It holds no licenses from any recognized financial authority.

3. When was the website created?

The domain was registered on August 19, 2025, making it a very new platform.

4. Are its trading volume and user claims reliable?

No evidence supports them. Website traffic is under 100 visits per month.

5. What account types are offered?

Five accounts with rising deposit requirements; the BLACK account has undisclosed minimums.

6. Does Trastix provide full contact details?

No physical address or phone number — only an email and basic chat.

7. Is it safe to use Trastix?

Traderknows warns of high risks due to no regulation and poor transparency.