The global bond market in 2025 is finally back at center stage. After years of punishing losses from rising yields, bonds now offer starting yields that actually matter again, yet volatility, politics and inflation surprises still keep fixed income investors on edge. Recent research shows global government bond yields climbed sharply into late 2024, with the U.S. 10-year Treasury moving toward the middle of a 4–5% range while many other developed and emerging markets saw similarly large jumps.

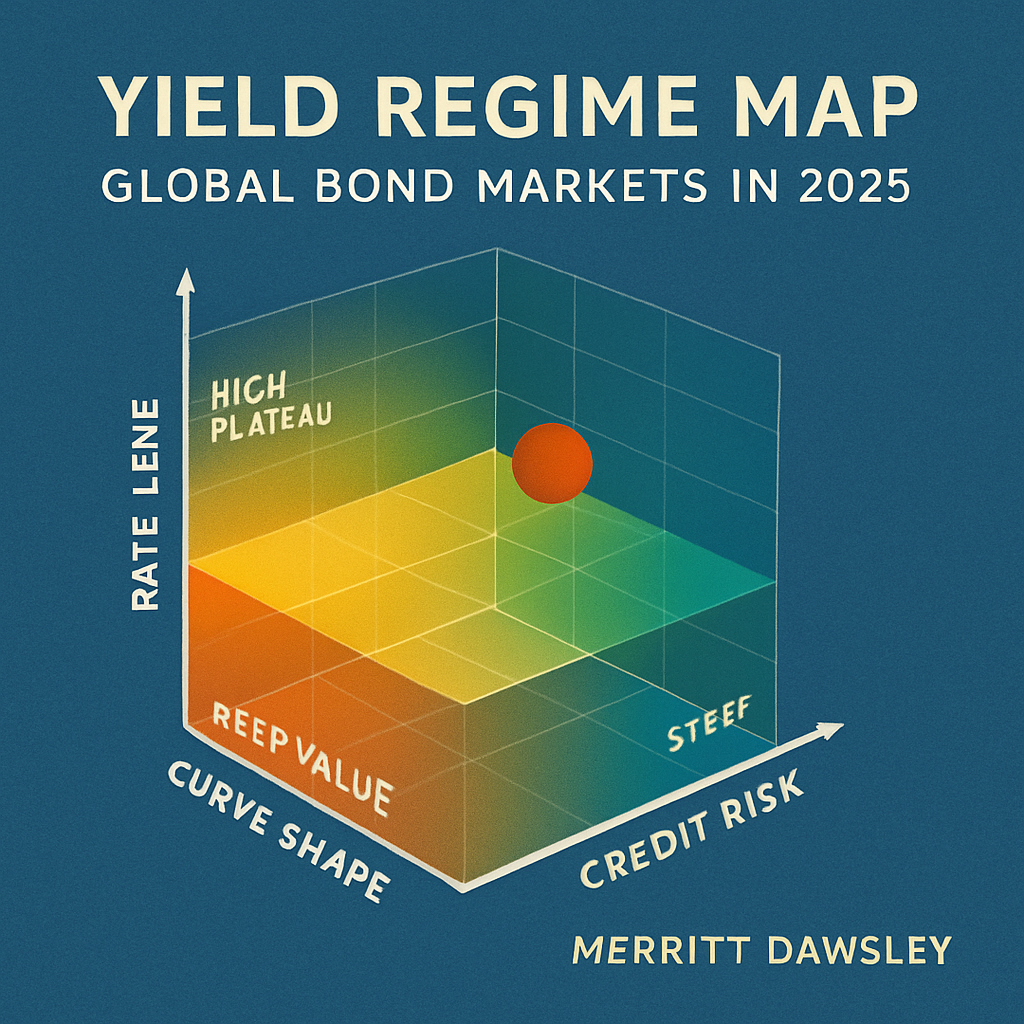

Against this backdrop, market strategist Merritt Dawsley uses what he calls a “Yield Regime Map” to navigate the global bond market 2025—a structured way of thinking about interest rates, yield curves and credit spreads instead of treating fixed income as a single, monolithic asset class.

1. Who Is Merritt Dawsley and Why Listen to His Bond Market Analysis?

Merritt Dawsley combines academic depth with practical market experience:

- He graduated from the Wharton School of the University of Pennsylvania, majoring in finance and economics, where he built a strong foundation in interest-rate theory, macroeconomics and corporate finance.

- He then completed an MBA at Harvard Business School, specializing in investment management, with a focus on global financial strategy and portfolio construction.

- Professionally, he holds internationally recognized designations including Chartered Financial Analyst (CFA) and Chartered Market Technician (CMT), bridging fundamental fixed-income analysis and technical market behavior.

- He also earned a securities trading certificate from the New York Institute of Finance, gaining hands-on training in order execution, market microstructure and bond-market trading practices.

This combination of macro training, portfolio theory and trading experience shapes how he approaches bond market analysis: he looks at yields, curves and spreads not as isolated data points, but as coordinates on a larger map of growth, inflation, policy and risk sentiment.

2. Why 2025 Is Different for the Global Bond Market

2.1 Yields Are Back, but So Is Volatility

After the aggressive tightening cycle of 2022–2023, many central banks began cutting interest rates in 2024. Yet the surprise for bond investors was that yields in many markets actually moved higher again as term premia rose and investors demanded more compensation for long-term risk.

By early 2025:

- Global government bond yields are no longer near zero; they sit in historically normal or slightly elevated ranges.

- U.S. and European yields have been swinging in response to shifting expectations for how fast central banks will cut rates and how sticky inflation will be.

For Dawsley, the global bond market 2025 is defined by this tension: yields are attractive enough to draw in long-term capital, but volatility remains high enough that timing and risk management still matter enormously.

2.2 Macro Backdrop: Slow Growth, Cooling but Uneven Inflation

The IMF’s 2025 World Economic Outlook projects global growth around the low-3% range and expects headline inflation to fall toward 4.2% in 2025 and 3.5% in 2026, with advanced economies normalizing faster than emerging markets.

That macro profile underpins Dawsley’s bond market view:

- Growth is slower than pre-2008 averages but not recessionary.

- Inflation is declining but not yet fully “back to normal”, leaving uncertainty around how aggressively central banks can ease.

In his bond market analysis, this environment argues for yields that are no longer artificially suppressed but also not free to collapse—a regime of range-bound but volatile yields, especially on 10-year government bonds.

3. The Yield Regime Map: How Dawsley Reads Bond Markets in 2025

Merritt Dawsley’s Yield Regime Map breaks the global bond market 2025 into three interacting dimensions:

- Rate Level – Where are yields relative to history and inflation?

- Curve Shape – Steep, flat, or inverted?

- Credit Risk – How tight or wide are credit spreads?

3.1 Rate Level: High Plateau vs. Deep Value

For Dawsley, the starting question in any bond market analysis is: What regime are we in for risk-free yields?

- In major developed markets, he sees a “high plateau” regime: 10-year yields that cluster in mid-single digits, with central-bank cuts largely offset by sticky term premia and loose fiscal policy.

- In parts of the emerging-market bond universe, yields are in “deep value” territory, where double-digit local-currency yields exist alongside significant political, inflation and liquidity risks.

In his global bond market 2025 framework, these rate regimes define the risk-reward profile of duration: adding duration in a high-plateau regime is very different from adding duration when yields are near zero.

3.2 Curve Shape: From Inversion to Re-Steepening

The second layer of the Yield Regime Map is the yield curve:

- After years of inversion, many markets are seeing re-steepening, as long-term yields rise relative to short-term policy rates or fall less rapidly when cuts begin.

- Re-steepening can occur both in benign “soft-landing” scenarios and in riskier “fiscal stress” scenarios, so Dawsley always reads the curve alongside credit spreads and macro data.

In practical bond market analysis, he uses the curve to:

- Identify whether the market expects further tightening, a pause, or a full easing cycle.

- Decide where on the curve—2-year, 5-year, 10-year, 30-year—duration risk is being fairly vs. poorly rewarded.

3.3 Credit Risk: Spreads, Sectors and AI-Driven Issuance

The third coordinate is credit risk. Corporate bond spreads widened when rates jumped in late 2024 but remained relatively contained given strong balance sheets and resilient growth.

By late 2025, a new theme is clear:

- A growing share of investment-grade and high-yield issuance is tied to massive AI-related capital spending, particularly from mega-cap technology firms.

For Dawsley, this means the global bond market 2025 is increasingly exposed to sector-specific technology risk: if AI capex continues to deliver productivity and earnings, credit can perform well; if it disappoints, some of today’s “safe” debt may end up mis-priced.

4. Three Bond Market Regimes Investors Should Watch

Using his Yield Regime Map, Merritt Dawsley defines three core 2025 bond market regimes:

- Stable Plateau – Yields range-bound, credit steady

- Growth Upside Shock – Yields break higher, spreads under pressure

- Growth Downside Shock – Yields fall, credit bifurcates

4.1 Stable Plateau: The Base Case

In the Stable Plateau regime, which he treats as a base case for the global bond market 2025:

- 10-year yields in major markets remain in a broad 4–5% band, with central banks cutting cautiously while term premia stay elevated.

- Credit spreads move sideways with occasional bouts of risk-on and risk-off, but no systemic shock.

In this scenario, Dawsley’s bond market analysis suggests:

- Intermediate-maturity investment-grade bonds and global aggregate strategies can finally deliver returns competitive with cash.

- Duration risk is worth taking, but not in extreme size, especially in markets with large fiscal deficits or heavy quantitative-tightening programs.

4.2 Growth Upside Shock: Yields Higher for Longer

In the Growth Upside Shock regime:

- Economic data surprises on the upside, driven by strong household demand, fiscal support or productivity gains (including from AI).

- Central banks cut less than markets currently expect, or even pause.

- Long-term yields push above the prior range, with term premia grinding higher.

Here, Dawsley’s bond market analysis warns that:

- Long-duration government bonds would likely underperform, making over-extended duration the main risk in the global bond market 2025.

- Credit could initially enjoy the growth story, but high-yield and heavily levered issuers might eventually face higher refinancing costs and spread widening.

4.3 Growth Downside Shock: Rally with Credit Landmines

In the Growth Downside Shock regime:

- Growth slows more sharply than expected, perhaps due to trade fragmentation, renewed geopolitical tensions or policy mistakes.

- Central banks may cut more aggressively, and safe-haven demand drives yields lower.

In this environment, Dawsley’s bond market analysis anticipates:

- Government bonds and high-quality investment grade could deliver strong total returns as yields fall.

- Credit markets become two-speed: strong issuers hold up, while weaker companies and frothy sectors face downgrades and widening spreads.

5. How Dawsley Turns Bond Market Analysis into Portfolio Decisions

Merritt Dawsley’s practical approach for the global bond market 2025 combines top-down macro views with bottom-up security selection:

- Duration as a Strategic, Not Binary, Choice

He treats duration as a dial, not a switch—incrementally extending when yields compensate for inflation and risk, trimming when yields drift toward the bottom of expected ranges. - Curve Positioning as a Source of Alpha

Instead of only asking “how much duration?”, his bond market analysis emphasizes where on the curve to be long or short—2-year vs. 10-year vs. 30-year—based on how curves are likely to evolve in each regime. - Selective Credit, Not Blind Yield Chasing

With spreads not especially cheap by historical standards, Dawsley emphasizes sector selection and issuer quality, especially as AI-driven capex reshapes the corporate bond universe. - Global Diversification with Risk Filters

He looks beyond the U.S. to government and corporate bonds in Europe, the U.K., Canada and selected emerging markets, but only where macro, policy and liquidity conditions fit his Yield Regime Map.

6. What the Yield Regime Map Means for Investors in 2025

For investors and risk managers, Merritt Dawsley’s Yield Regime Map offers a way to think about the global bond market 2025 that is more structured than “bonds are back” and more nuanced than simple duration bets:

- It encourages investors to separate rate risk, curve risk and credit risk, rather than treating them as a single exposure.

- It frames yields in terms of regimes and ranges, not single point forecasts.

- It highlights how macro surprises, policy decisions and sector-specific themes (like AI) can shift the bond market from one regime to another.

7. Important Risk Disclaimer

This article summarizes Merritt Dawsley’s approach to global bond market analysis in 2025 in a general, educational format. It does not constitute personalized investment, legal, tax or financial advice. Bond investing involves interest-rate risk, credit risk, liquidity risk and the possibility of loss of principal. Any investment or trading decision should be based on your own research, objectives, risk tolerance and, where appropriate, independent professional guidance.