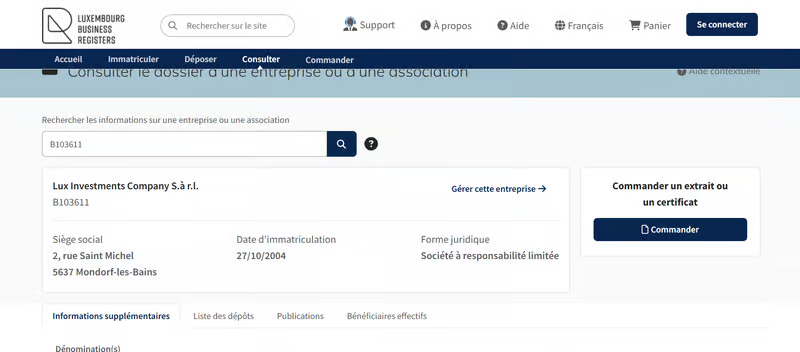

Luxkonto presents itself as a premium trading service provider from Luxembourg, yet a closer look at its structure and transparency raises serious questions about its legitimacy. Operating under the name LUX INVESTMENTS COMPANY S.À R.L., the firm is registered with the number B103611 and LEI 222100UEWST8QRT4AF55. Although this registration confirms the entity’s legal existence in the Luxembourg Business Registers (LBR), it holds no financial authorization from the CSSF (Commission de Surveillance du Secteur Financier)—Luxembourg’s primary financial regulator.

Brand Background and Legal Standing

Entity Verification

Records from the LBR verify the registration of LUX INVESTMENTS COMPANY S.À R.L., giving Luxkonto a traceable corporate footprint. However, registration alone does not equal regulation. Without CSSF oversight, the company cannot lawfully provide investment or brokerage services in Luxembourg’s regulated market.

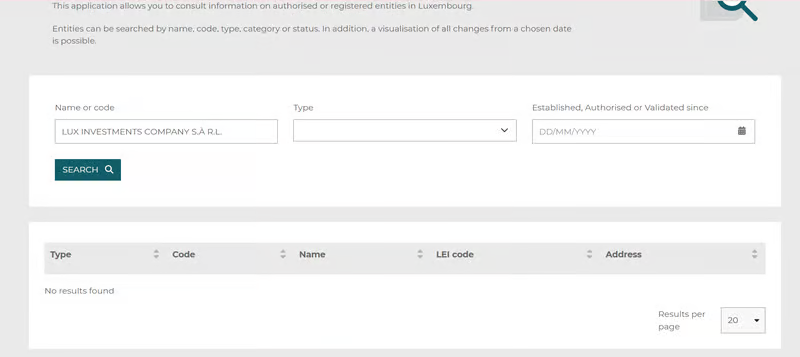

Regulatory Gap

A search through the CSSF database confirms that Luxkonto is not listed as a licensed investment firm. This lack of regulation places clients at risk, as there are no guarantees of fund protection, dispute resolution mechanisms, or compliance monitoring.

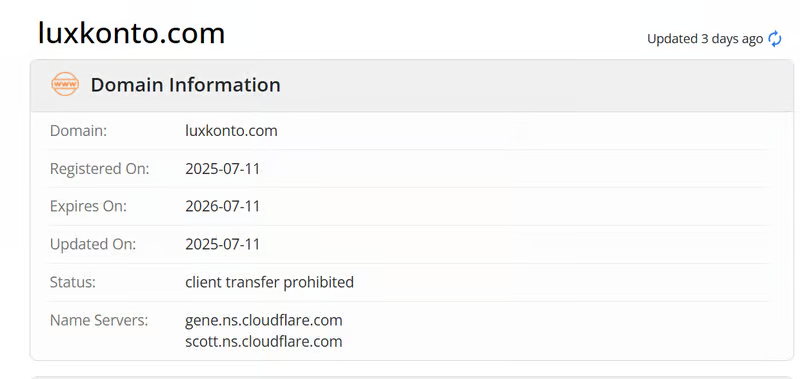

Online Presence and Domain Record

Website and Domain Registration

Luxkonto’s official domain, https://luxkonto.com, was created on July 11, 2025, and updated on the same day. This short domain lifespan suggests a newly established and untested platform. In the online trading sector, domain age often serves as an indirect indicator of credibility, with short-lived domains typically lacking a verifiable operational history.

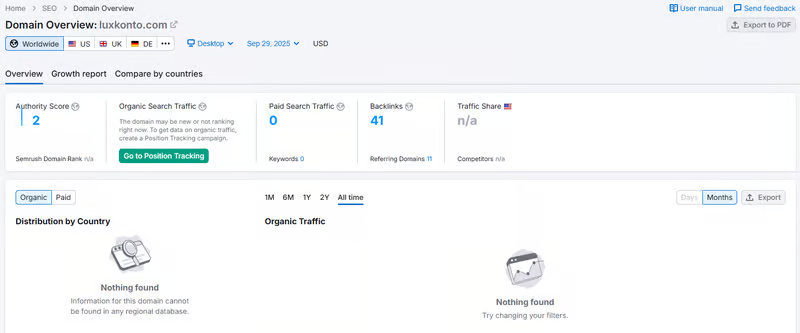

Traffic and Market Reach

Website analytics from Semrush show near-zero monthly visitors, highlighting the brand’s limited exposure and possible absence of active traders. This low engagement contrasts sharply with legitimate, well-established brokers that attract consistent global traffic.

Trading Offer and Platform Transparency

Product Portfolio

Luxkonto claims to offer an extensive range of instruments — forex, indices, commodities, stock CFDs, ETFs, and bonds. While the variety appears comprehensive, no details are provided about liquidity providers or trading execution quality, leaving questions about the authenticity of these offerings.

Claimed Platforms

The broker advertises support for MT4 and PRO Trader, yet independent verification finds no record of Luxkonto on the official MT4 broker list. This discrepancy implies that the trading software might not be connected to any regulated or verifiable market feed.

Account Structure and Target Clients

High Investment Thresholds

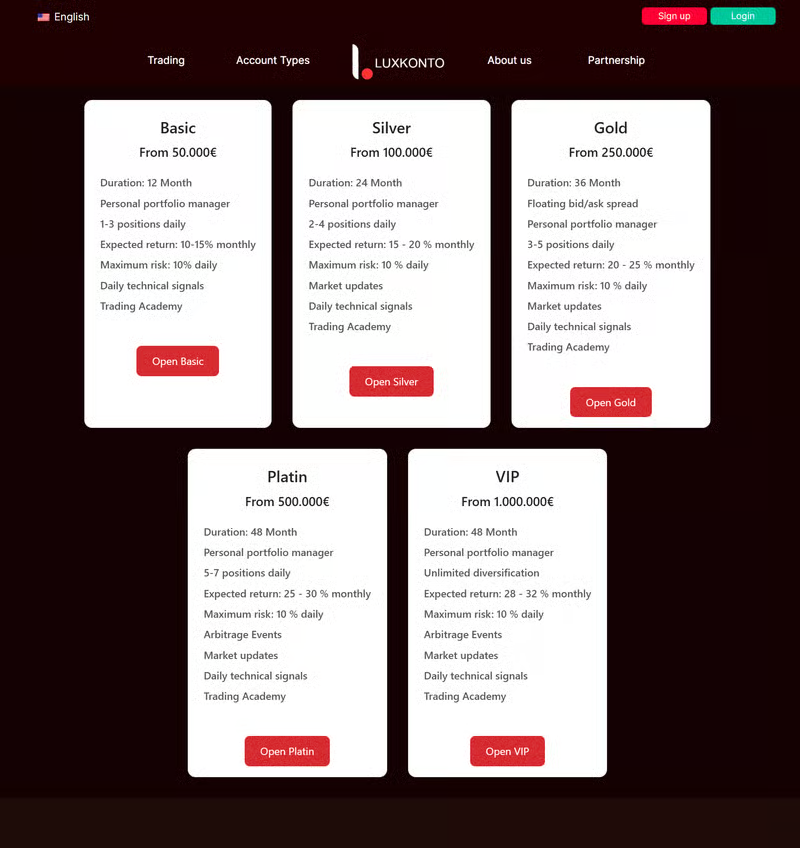

Luxkonto markets five account tiers, all requiring extremely high minimum deposits — ranging from €50,000 to €1,000,000.

- Basic: €50,000, 12-month term, 10–15% monthly return.

- Silver: €100,000, 24-month term, 15–20% monthly return.

- Gold: €250,000, 36-month term, floating spreads.

- Platinum: €500,000, 48-month term, arbitrage access.

- VIP: €1,000,000, “full investment diversification.”

These investment requirements far exceed industry norms and are coupled with unrealistic return promises that lack audited performance proof—typical red flags of non-transparent investment schemes.

Missing Operational Details

Deposit and Withdrawal

Luxkonto does not specify payment channels, processing times, or fee structures for deposits and withdrawals. Without this information, users cannot assess the security or reliability of fund transfers.

Educational Content and Client Resources

No training materials, webinars, or tutorials are offered on the website. For a company claiming to serve serious investors, the absence of educational content undermines credibility and professionalism.

Agency and IB Program

While the website briefly references an Introducing Broker (IB) partnership, it omits key information about commission plans or reward structures, showing little transparency compared to established brokerage standards.

Contact Information and Offices

Luxkonto lists its headquarters at 2, Rue Saint Michel, Mondorf-Les-Bains, Luxembourg, and a secondary office in World Trade Center Genève, Switzerland.

Contact options include:

- Email: [email protected]

- Phone (LU): +352 28 43 13 07

- Phone (CH): +41 44 70 72 931

However, there is no verified evidence that these contact points correspond to actual, staffed offices or licensed business premises.

Social Media and Public Visibility

Luxkonto maintains no verified social media presence on any major platforms. This complete absence of LinkedIn, Facebook, or Twitter accounts prevents public interaction and limits accountability — an unusual trait for a broker claiming to manage high-value client portfolios.

FAQ about Luxkonto

What is Luxkonto?

Luxkonto is an online trading platform operated by LUX INVESTMENTS COMPANY S.À R.L. in Luxembourg, offering access to forex and CFD products.

Is Luxkonto regulated by the CSSF?

The firm is registered in Luxembourg but does not appear on the CSSF’s list of authorized or licensed brokers.

What platforms does Luxkonto provide?

It claims to offer MT4 and PRO Trader trading software, though confirmation of functional access may be necessary.

What is the minimum investment required?

The platform’s entry-level account starts from €50,000, positioning it toward investors with larger capital.

Does Luxkonto offer educational tools?

Its website currently does not feature detailed training, tutorials, or learning resources for traders.

How can Luxkonto be contacted?

The broker lists offices in Luxembourg and Switzerland, providing communication through email and phone numbers.