Recently, a digital asset trading platform named Wzzph (Wzzph Global Ltd) has entered the public eye, claiming to provide a comprehensive range of services including cryptocurrency spot trading, perpetual contracts, and lending. The platform emphasizes its compliance registration in the United States, aiming to create a safe and reliable investment environment. However, a deeper analysis of its public information reveals a series of significant doubts and potential risks beneath its professional appearance.

The “Packaged” U.S. Regulatory Credentials

The core selling point of Wzzph is its two U.S. “licenses”: FinCEN’s MSB registration and SEC’s Form D filing. However, these two documents hold negligible actual value in the field of cryptocurrency trading regulation, serving more as a marketing strategy.

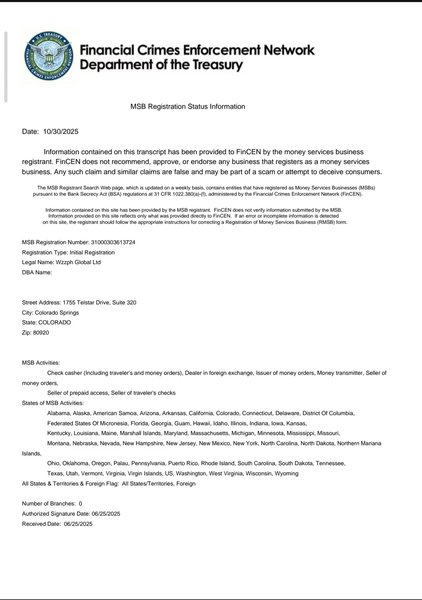

Misleading FinCEN MSB Registration: Wzzph is indeed registered with FinCEN (Financial Crimes Enforcement Network) as an MSB (Money Services Business), number 31000303613724. However, it must be clarified:

- MSB is not an Operating License: FinCEN officially states that MSB registration only signifies that the entity has fulfilled its “registration obligation,” and does not imply FinCEN’s approval, recommendation, or endorsement.

- Mismatched Regulatory Scope: The core regulatory responsibilities of MSB are anti-money laundering (AML) and counter-terrorism financing (CFT), with its scope of business (like currency exchange and remittance services) not involving the structure, matching mechanism, or derivatives trading of cryptocurrency exchanges.

- Wzzph packages this registration as proof of “compliant operation,” which is a typical use of information asymmetry to seriously mislead investors.

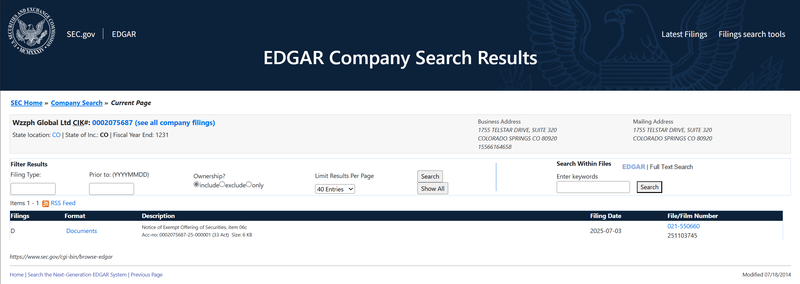

SEC Form D’s “Exemption” Filing: Wzzph also has a Form D filing (CIK: 0002075687) in the SEC (U.S. Securities and Exchange Commission) database. This document is not “approval” but rather an “exemption notice.”

- Form D is applicable to private placements, aiming to inform the SEC “I am conducting a fundraising with an exemption from public offering,” which allows avoiding the rigorous scrutiny like an IPO.

- The SEC does not conduct substantive reviews on Form D documents, nor does it endorse them. The SEC has repeatedly warned investors to be wary of entities abusing the Form D filing, falsely claiming their “SEC registration has been obtained.”

- Wzzph, as a trading platform targeted at the public, uses a private offering exemption document to imply compliance, a practice that is extremely opaque and deceptive.

Conclusion: The so-called “dual U.S. regulation” by Wzzph is a carefully constructed illusion. The documents it possesses are “filings” rather than “licenses,” providing almost no substantive protection for investors and failing to legally support its global cryptocurrency trading operations.

“Shell” Operation History and Zero Traffic

The operational history and user base of a platform are crucial indicators of its credibility. Wzzph exhibits significant doubts in this regard as well.

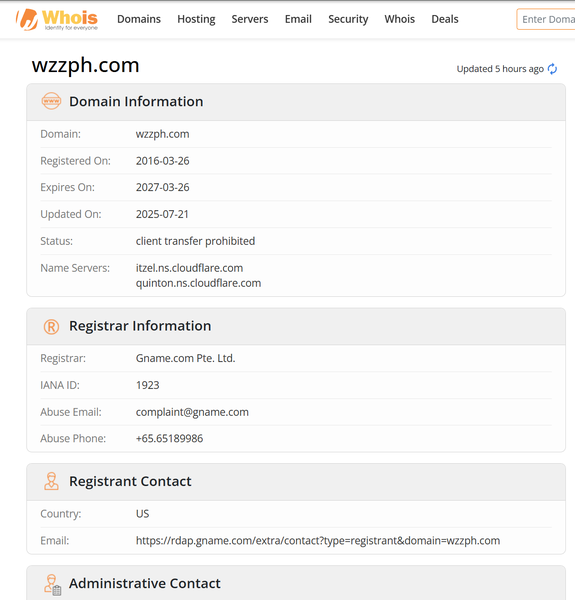

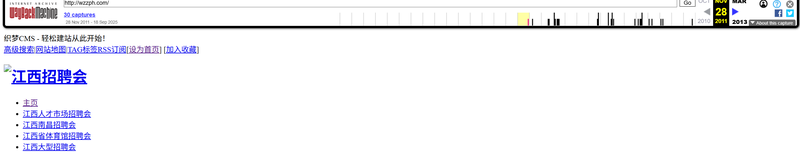

Fake “Credentials”: Its official website domain, wzzph.com, was registered in 2016, suggesting years of industry accumulation. However, historical snapshots from the Internet Archive (Wayback Machine) show that the domain displayed recruitment-related content for a long time. It wasn’t until October 18, 2025 (recently) that the site first featured content related to trading platforms.

This indicates that Wzzph is a completely new platform using an “old domain” to fabricate operating history in an attempt to build false trust.

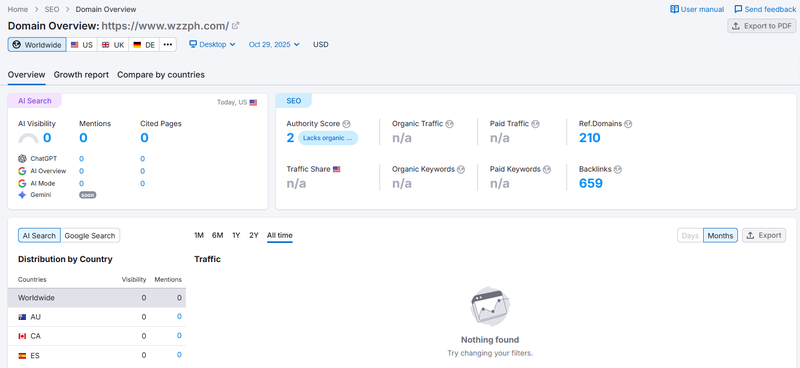

Nonexistent Real Users: Data from authoritative third-party website traffic monitoring tools (e.g., Semrush) show that Wzzph’s official website’s monthly average traffic is 0.

- This data is fatal. A platform claiming to offer over 300 trading pairs and supporting API and OTC services has no natural traffic at all.

- This strongly indicates that Wzzph is a “ghost platform”—merely a front-end display with no real users or genuine trading activities. The authenticity of all its claimed features (like trading depth and C2C services) must be heavily questioned.

Anonymous Team with Unknown Identities

A transparent team background is the cornerstone of any legitimate financial institution. Wzzph’s “About Us” page lists the names and photos of a few core team members, but that is all.

- Unverifiable Information: The official site provides no specific resumes, professional backgrounds, or verifiable third-party information (such as LinkedIn profiles) for these members.

- High Anonymous Risk: Investors cannot know who the actual operators of this platform are, their professional capabilities, or even if they truly exist. This “anonymous operation” status provides perfect cover for potential fraud and “runaway” actions.

Summary

In summary, the Wzzph platform displays all the typical characteristics of a high-risk scam project:

- Regulatory Impersonation: Using low-threshold filings unfamiliar to ordinary investors (MSB, Form D), packaging them as strong regulatory licenses, and engaging in false advertising.

- History Forgery: Utilizing an old domain to fabricate operational history, hiding its recently established (October 2025) fact.

- Data Shell: Website traffic is zero, confirming it as a “ghost platform” with no real business, whereby all trading data and functions might be fabricated.

- Anonymous Team: The core team information is unverifiable, lacking accountability and transparency.

Conclusion: Wzzph is not a legitimate digital asset trading platform but rather a highly suspicious fraudulent investment trap. Its target audience is clearly those lacking discernment, attracted by “U.S. compliance” and “diverse products.” We strongly urge all investors to remain highly vigilant, stay away from such high-risk platforms, and avoid irreversible financial losses.