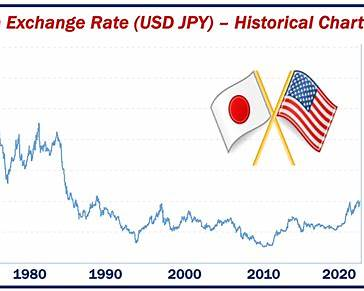

The Japanese yen has fallen noticeably against the U.S. dollar, with USD/JPY trading around ¥150.96 per dollar on October 20, 2025, following the announcement that Sanae Takaichi is poised to become Japan’s next prime minister. Takaichi’s ascension—backed by a coalition between the ruling Liberal Democratic Party (LDP) and the Japan Innovation Party—revives expectations of expansionary fiscal policy and loose monetary settings, thereby fueling a “Takaichi trade” outlook (risk-on equities, weaker yen). Meanwhile, Japan’s Finance Minister Katsunobu Kato publicly warned of the dangers of disorderly currency moves as the yen slid to two-month lows.

Background Context

The yen’s decline is rooted in a number of inter-locking factors. First, markets had already priced in that the Bank of Japan (BoJ) would continue with very accommodative policy, given Japan’s persistent low inflation and weak growth. The prospect of a leadership change toward someone (Takaichi) likely comfortable with fiscal stimulus and weaker currency amplified that view.

Second, global risk sentiment has improved as concerns about U.S. regional banks eased and trade-tension rhetoric between the U.S. and China moderated. A weaker safe-haven yen often follows improved risk appetite.

Third, the currency markets are also reacting to divergence: while the U.S. may still expect rate cuts by the Federal Reserve, Japan is not signalling tightening—in fact, the opposite—which tends to favour the dollar versus the yen.

In sum: domestic Japanese politics, monetary-fiscal policy expectations, and global risk shifts all converged to trigger a meaningful move in the FX market.

Why This News Matters

This development matters on several fronts for FX traders, global investors and corporations with currency exposure.

Currency Pair Impact & Market Sentiment

The yen’s weakness means that USD/JPY is gaining upward momentum. That makes holding the dollar versus the yen more attractive. For companies earning in yen, it raises import costs and pushes up inflationary pressure in Japan. For traders in FX pairs, volatility is likely to increase—especially if the BoJ confirms further stimulus.

Broader FX and Monetary Policy Implications

The move underscores how monetary and fiscal policy expectations are among the key drivers of currency valuations. A shift toward more fiscal stimulus in Japan may weigh on the yen long term and could trigger intervention risks (which the Finance Minister already referenced). For global markets, a weaker yen tends to boost Japanese exports (making them more competitive) but also imports inflation.

Investor & Corporate Risk Management

For multinational companies with operations in Japan or currency hedging needs, this is a red flag to reassess yen exposure. Hedging costs may rise, and the currency mis-match risk tightens. Similarly, for global investors, a collapsing yen may push Japanese equities higher (exporters benefit) but raise inflation risk domestically, potentially eroding real returns.

Link to Global FX Trends

This story ties into the broader theme that the United States Dollar (USD) remains dominant in FX markets—as the Bank for International Settlements recently noted USD involvement in 89% of trades. Moreover, the yen’s slide fits the seasonal pattern noted in October: historically a weak month for USD/JPY.

Our Expert Take

What-If Scenarios & Trading Implications

Given the current backdrop, here are our professional views:

- Base case: Takaichi becomes prime minister and maintains strong fiscal stimulus while BoJ stays ultra-accommodative. Under this scenario, USD/JPY could move toward ¥155 or higher by year-end as policy divergence widens.

- Risk to this base case: If the BoJ unexpectedly signals tightening (unlikely but not impossible) or intervenes to support the yen, then the move could reverse sharply. The minister’s warning about “disorderly” moves hints at such a possibility.

- Technical perspective: On the chart, the key support level for USD/JPY lies around ¥147 (a convergence of trend-line, moving average). A break below could indicate a change of tone. Resistance could be seen near ¥152-154, so close monitoring is needed.

Recommendations for Traders & Corporates

- Hedging: Corporates exposed to yen liabilities should consider locking in forward contracts now, rather than waiting for a worse rate.

- FX Traders: Long-dollar vs yen remains a viable trade, but size your position carefully and set stop losses near support levels. Look also for opportunities where yen weakness might spill into other Asian FX crosses (KRW, TWD).

- Diversification: Don’t assume unilateral direction; monitor BoJ commentary, inflation data in Japan, and global risk sentiment. Should risk aversion return, the yen could temporarily strengthen as a safe-haven.

Longer-Term Implications

Over the medium term, the yen’s slide raises a red flag for Japan’s inflation and current-account dynamics. A weaker currency increases import costs, which could squeeze households and reduce consumption. Exporters gain—but only if global demand holds up. Meanwhile, global carry trades (borrowing yen to invest in higher-yield currencies) may resurface, increasing FX volatility further.

In the broader macro-framework, this episode reminds us that currency markets factor in expectations of future policy and growth, not just current data. As we head into the end of 2025, with multiple central bank decisions pending (including the BoJ) and macro data still subject to surprises, traders and investors need to stay agile.

Final Word

The yen’s decline is not just a headline move—it is a signal of changing expectations in Japan’s policy framework and the global currency landscape. For FX participants, this offers opportunities—but also risks. Stay alert, hedge accordingly, and ensure you’re not caught off-guard by swift directional shifts. As expert observers, we believe the path of least resistance for USD/JPY remains upward in the near term—but strong discipline is required.