# Unraveling the Mystery: Is Wealth Alliances a Legit Financial Advisory or Just Another Scam?

In the intricate landscape of financial advisories, discerning the legitimacy of a firm is paramount. Wealth Alliances, a name that has surfaced prominently in recent times, beckons an in-depth analysis to ascertain whether it stands as a credible financial partner or merely another deceptive entity. This article aims to unravel the complexities surrounding Wealth Alliances by examining its operational framework, client testimonials, and regulatory compliance, thereby providing clarity to potential investors.

Understanding Wealth Alliances

by Sean Pollock (https://unsplash.com/@seanpollock)

At the core of any financial advisory lies its mission and operational ethos. Wealth Alliances purports to offer bespoke financial strategies, tailored to individual and corporate clients. The firm positions itself as a specialist in creating wealth through diversified investment portfolios, tax optimization strategies, and retirement planning. However, the efficacy and authenticity of such claims necessitate a closer inspection.

The Framework of Financial Partnerships

The construct of financial partnerships often dictates the success of wealth management firms. Wealth Alliances claims to employ a comprehensive approach, integrating client-specific goals with broad market insights to forge robust financial partnerships. This section delves into the methodologies employed by Wealth Alliances to facilitate these partnerships and evaluates their effectiveness in delivering promised outcomes.

Strategic Wealth Management

Wealth Alliances promotes a strategic wealth management model, emphasizing long-term growth and security. This involves a meticulous assessment of client assets, risk appetite, and future aspirations, which purportedly guides the creation of personalized wealth strategies. Critics, however, argue that such strategies are not sufficiently transparent or backed by concrete evidence of success.

Client Testimonies and Experiences

by Patrick Tomasso (https://unsplash.com/@impatrickt)

Testimonials serve as a pivotal element in assessing the credibility of any advisory firm. Wealth Alliances showcases a myriad of client experiences, predominantly highlighting successful financial transformations and enhanced fiscal stability. However, potential investors should approach these narratives with caution, as they may not fully encapsulate the breadth of client experiences.

Regulatory Compliance and Accreditation

A legitimate financial advisory must adhere to stringent regulatory standards and possess requisite accreditations. Wealth Alliances’ compliance with financial regulations, as well as its affiliations with recognized financial bodies, is a critical indicator of its authenticity. This subsection scrutinizes the firm’s regulatory standing and evaluates its compliance with industry standards.

The Role of Financial Oversight

Regulatory bodies play an essential role in maintaining the integrity of financial advisories. Wealth Alliances’ alignment with regulations set forth by financial oversight organizations, such as the Financial Conduct Authority (FCA) or the Securities and Exchange Commission (SEC), is instrumental in establishing its credibility.

Analyzing Wealth Strategies

The cornerstone of Wealth Alliances’ service offering is its wealth strategies. A thorough analysis of these strategies is necessary to determine their viability and alignment with market realities. This section explores the intricacies of Wealth Alliances’ investment tactics, risk management approaches, and innovative solutions purportedly designed to maximize client wealth.

Investment Tactics and Market Positioning

Investment tactics are pivotal in differentiating a legitimate advisory from a fraudulent one. Wealth Alliances claims to employ a diversified investment approach, leveraging both traditional and alternative asset classes to optimize returns. The firm’s market positioning, in terms of asset allocation and risk mitigation, warrants a detailed examination to validate its strategic prowess.

Risk Management Protocols

by Scott Graham (https://unsplash.com/@homajob)

A robust risk management protocol is indispensable for any credible financial advisory. Wealth Alliances asserts its commitment to safeguarding client assets through advanced risk assessment tools and proactive monitoring. The effectiveness of these protocols in mitigating market volatility and ensuring client security is a focal point of this analysis.

Weighing the Pros and Cons

In determining the legitimacy of Wealth Alliances, it is essential to weigh the advantages and potential drawbacks associated with its services. This section provides a balanced overview of the firm’s strengths and areas of concern, informed by both client feedback and expert evaluations.

Advantages of Wealth Alliances

- Personalized Approach: Wealth Alliances prides itself on delivering tailored financial strategies, purportedly enhancing client satisfaction and success rates.

- Comprehensive Services: The firm’s breadth of services, ranging from investment management to tax planning, positions it as a versatile financial partner.

- Experienced Advisors: Wealth Alliances claims to employ a team of seasoned financial professionals, which, if true, adds a layer of expertise to its advisory services.

Potential Concerns and Red Flags

- Transparency Issues: Some critics highlight a lack of transparency in Wealth Alliances’ operations, particularly regarding fee structures and performance metrics.

- Client Disparities: Variability in client experiences raises questions about the consistency of service delivery and outcomes.

- Regulatory Challenges: Any lapses in regulatory compliance could significantly undermine the firm’s legitimacy and client trust.

Final Verdict: Scam or Legit?

In conclusion, the legitimacy of Wealth Alliances as a financial advisory hinges on multiple facets, including its adherence to regulatory standards, the authenticity of client testimonials, and the efficacy of its wealth strategies. While the firm presents a compelling case through its service offerings and claimed successes, potential investors should exercise due diligence, seeking independent reviews and conducting thorough research to ensure informed decision-making.

Wealth Alliances, like any financial advisory, must be scrutinized through the lens of regulatory compliance, client satisfaction, and strategic integrity to ascertain its true standing in the financial landscape.

Original text:

Wealth Alliances claims to be a financial advisory company headquartered in Philadelphia, Pennsylvania, USA, established in 2019. However, domain registration information indicates that the company’s official website domain was actually registered on September 8, 2024. This discrepancy raises doubts about the authenticity of the company’s founding date.

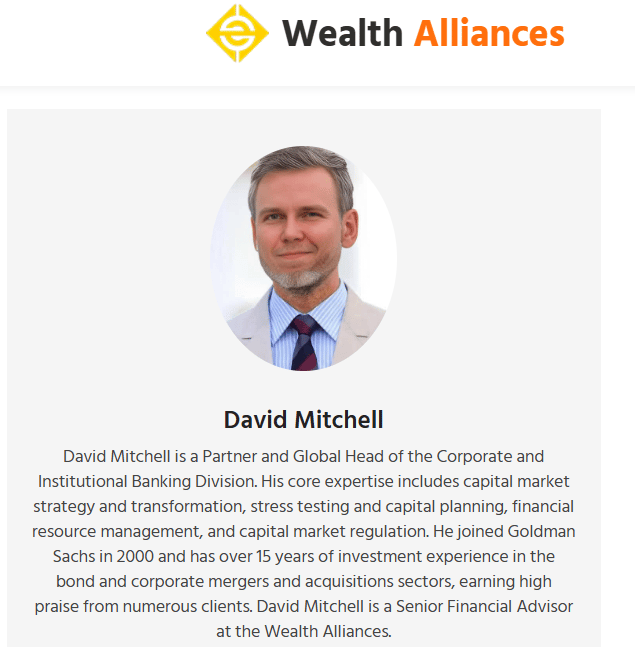

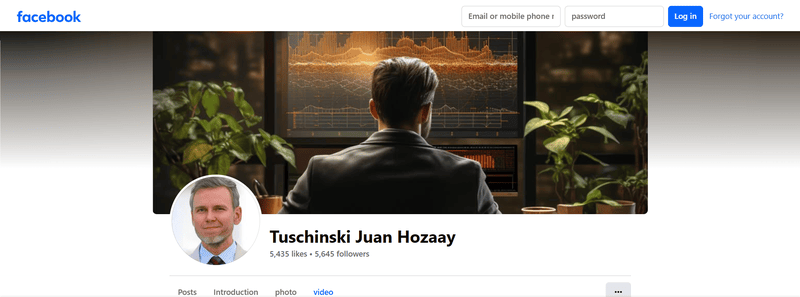

Team Information Concerns

The website lists team members including Ethan James and James Parker, but no relevant information could be found through public channels. A member named David Mitchell has a profile picture identical to one used by a social media user “Tuschinski Juan Hozaay.” This situation has led to skepticism about the team’s authenticity, although there isn’t enough evidence to further confirm these identities at present.

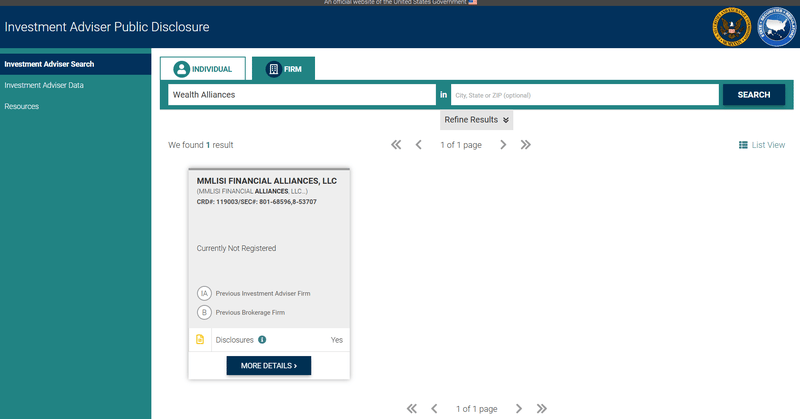

Service and Regulatory Issues

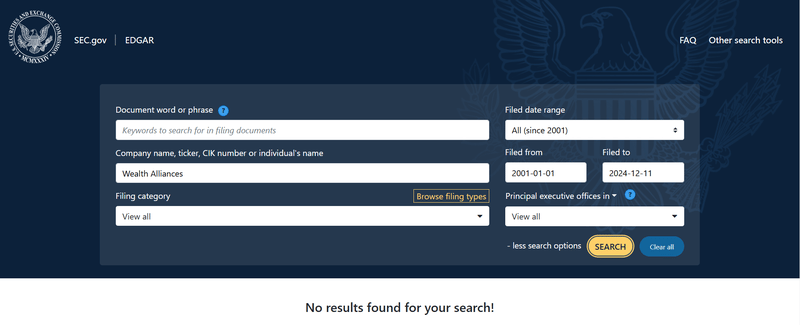

Wealth Alliances claims to offer investment advisory and financial planning services, managing over 1,000 investments valued at up to 400 billion dollars. Yet, public records from the U.S. Securities and Exchange Commission (SEC) reveal no registration information linked to the company.

Furthermore, the website does not disclose the company’s entity details or any regulatory qualifications held. This lack of information not only casts doubt on the authenticity of its business claims but also makes it challenging to verify its compliance.

Contact Issues

Although Wealth Alliances’ website is elegantly designed, it provides relatively limited information, especially in terms of contact details, listing only an email address ([email protected]) and a Telegram account, without a phone number or other formal contact methods. This hinders clients’ ability to learn more about the company and impacts its transparency evaluation.

Brand Influence

The company’s website claims to have a broad brand recognition and strong managerial achievements within the industry. However, a query through traffic analysis tool Semrush shows its website’s average monthly visits are zero. This indicates that the platform currently lacks a user base, which starkly contrasts its promotional content, although this may be due to the brand being in its early stages or insufficient marketing.