Introduction

In recent years, the global financial markets have seen rapid growth, with forex and cryptocurrency trading becoming hot topics among investors. However, with increasing demand for trading platforms, numerous online brokers have emerged, including both legitimate platforms and those that operate without regulation, transparency, or legality. SmartyTrade is one such controversial broker. Claimed to have been established in 2021, the platform offers forex and cryptocurrency trading services. However, closer scrutiny of its registration details, operational legitimacy, and regulatory status raises serious concerns. This article provides a comprehensive analysis of SmartyTrade’s background, operations, and risks, offering guidance to investors on selecting a reliable broker and avoiding potential pitfalls.

1. Background and Current Status of SmartyTrade

1.1 Company Overview

SmartyTrade describes itself as a forex and cryptocurrency broker registered in the Marshall Islands and operated by Omla LTD. According to its official website, the platform offers various financial instruments for trading, claiming to be a leading global online broker. However, the website lacks key details such as the company’s headquarters address, account types, or trading conditions, making it difficult for investors to evaluate the platform’s reliability.

1.2 The Truth About Its Registration

A search of the Marshall Islands International Registries (IRI) confirms that Omla LTD was once registered there. Further investigation shows that authorities canceled the company’s registration on February 15, 2023. This cancellation strips Omla LTD of its legal status, raising serious doubts about SmartyTrade’s legitimacy and operations.

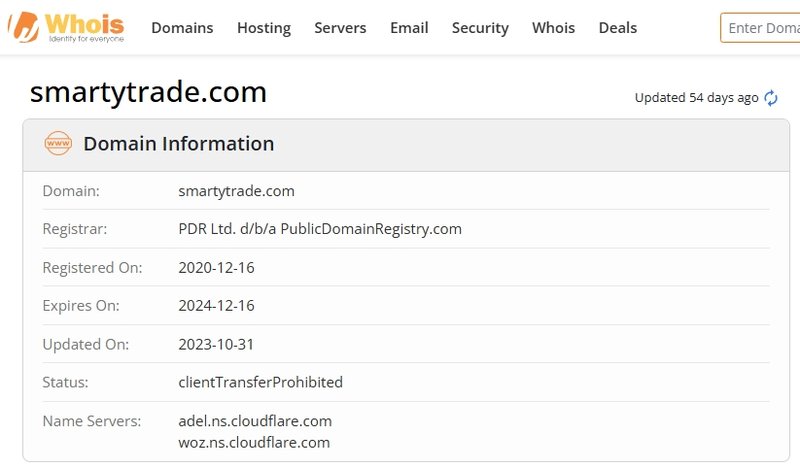

1.3 Website Registration and Instability

SmartyTrade’s website was registered in 2020, giving it a relatively short operational history. Coupled with the cancellation of its registration, this short tenure highlights the platform’s instability and raises questions about its credibility.

2. Impact of Registration Cancellation

2.1 Loss of Legal Status

Once a company’s registration is canceled, it ceases to exist as a legal entity. This means SmartyTrade can no longer legally sign contracts, receive regulatory oversight, or conduct business activities. From a legal perspective, SmartyTrade’s operations are now entirely unprotected by law.

2.2 Threats to Investor Rights

The cancellation of SmartyTrade’s registration significantly jeopardizes investor rights. Without legal status, the platform offers no protection for investor funds, leaving them vulnerable to mismanagement or fraud.

2.3 Suspicions of Being a Shell Company

Following the cancellation of its registration, SmartyTrade could potentially operate as a shell company, relying on its past registration to gain investor trust while continuing operations illegitimately. These practices often indicate fraudulent schemes, so investors should stay cautious about the platform’s potential misconduct.

3. Risks of Missing Information on the Website

3.1 Transparency Issues

SmartyTrade’s official website does not provide crucial information about the company’s address, key personnel, or operational team. Furthermore, it lacks details about account types and trading conditions. This lack of transparency directly impacts the platform’s credibility.

3.2 Potential Risks to Investors

Platforms with missing or vague information often pose the following risks:

- Concealing True Operations: The company may falsify its background or exaggerate its capabilities.

- Non-Compliant Fund Management: Investor funds may not be segregated from company assets, increasing the risk of misuse.

- Difficulty Tracing Accountability: When problems arise, it becomes challenging to identify the responsible party or hold them accountable.

4. Lack of Regulation: The Key Concern for Investors

4.1 The Importance of Regulation

Regulatory oversight is crucial in the financial industry, ensuring that platforms operate legally and transparently while protecting investor rights. Legitimate brokers typically hold licenses from reputable authorities such as the UK’s FCA, the US NFA, or Australia’s ASIC.

4.2 SmartyTrade’s Regulatory Status

SmartyTrade holds no regulatory licenses. The absence of any oversight leaves its operations entirely unmonitored. As a result, the platform’s trading practices, fund management, and overall transparency are highly questionable.

4.3 Risks of Unregulated Platforms

- Trading Manipulation: Unregulated platforms may interfere with trading results to generate illicit profits.

- Funds Misappropriation: Investor funds are at risk of being misused or embezzled.

- No Legal Recourse: Investors have no regulatory authority to turn to in the event of disputes or financial losses.

5. Marketing Tactics and Investment Risks

5.1 The Temptation of Low Deposit Requirements

SmartyTrade’s minimum deposit requirement of just $200 is designed to attract beginner investors. However, this low barrier to entry may be a strategy to gather funds quickly, raising concerns about the platform’s intentions.

5.2 Exaggerated Claims and Potential Fraud

Unregulated platforms often lure investors with promises such as guaranteed high returns or zero-risk trading, but these claims are typically unsupported by evidence.

5.3 A Warning for Investors

Investors should remember that any promises made by unregulated platforms are unreliable, and the risks of trading on such platforms are borne solely by the investors themselves.

6. Comparing SmartyTrade with Regulated Platforms

6.1 Legality

- SmartyTrade: Registration canceled, no legal standing.

- Regulated Platforms: Fully registered and compliant with regular audits.

6.2 Fund Management

- SmartyTrade: Unclear fund allocation, no segregated accounts.

- Regulated Platforms: Investor funds are segregated and protected by insurance.

6.3 Customer Support

- SmartyTrade: Limited customer service options on the website.

- Regulated Platforms: Offer multi-channel support, including phone, email, and live chat.

7. How Can Investors Protect Themselves?

7.1 Verify Platform Credentials

Use official channels to check the platform’s registration and regulatory licenses before making investments.

7.2 Seek Transparency

Opt for platforms that provide clear information about trading conditions, fund management, and contact details.

7.3 Start with Small Investments

Limit your initial investment to a small amount until the platform’s reliability is confirmed.

7.4 Research User Feedback

Look for reviews and testimonials from other investors to assess the platform’s reputation and performance.

8. Conclusion and Recommendations

SmartyTrade claims to offer forex and cryptocurrency trading services but raises significant red flags due to its canceled registration, lack of regulation, and opaque operations. Investors are strongly advised to avoid platforms with such questionable credentials. Instead, prioritize brokers that are licensed, regulated, and transparent to ensure the safety of your funds and trading activities.

In the volatile financial markets, protecting your rights and investments is paramount. Opting for legitimate platforms with robust oversight is the first step toward achieving long-term, stable returns. For platforms like SmartyTrade, caution and skepticism are essential.

FAQ: Frequently Asked Questions About SmartyTrade

1. Is SmartyTrade a legitimate platform?

No. Its registration was canceled in February 2023, and it lacks legal standing to operate.

2. Is SmartyTrade regulated?

No, SmartyTrade is not regulated by any financial authority.

3. Why was SmartyTrade’s registration canceled?

The reasons are unclear but could be due to operational issues or failure to comply with local laws.

4. How can I check if a trading platform is safe?

Verify its regulatory status through official channels, check its transparency, and read user reviews.

5. Is it safe to trade on SmartyTrade?

No. The platform’s lack of regulation and canceled registration pose significant risks to investors.

6. What are some alternatives to SmartyTrade?

Consider regulated platforms like eToro, IG, or Plus500, which are licensed by reputable authorities such as the FCA, ASIC, or NFA.